Download a PDF of this policy brief.

Summary

This policy brief discusses trends in public food stockholding (PSH) programs in developing countries noting three key takeaways: (1) Buffer stocks are making a comeback. Interest and national investment in PSH has re-emerged as countries seek to address challenges of price and supply volatility as well as safeguarding food security; (2) experience in Southeast Asia and Africa shows that regional stock programs are a viable option for developing buffer stocks that are accessible to low-income countries with limited national budgets; and (3) we see a potential role for farmers and other private sector actors in managing PSH programs. This role would need to be managed in a carefully structured governance framework, given the unequal power dynamics between large and small producers and traders, and to determine what commodities would be stored, where, and how to release stocks.

The trends on PSH discussed in this brief occur against a background of recurring global food crises, starting in 2007-2008, during which global prices and grain supplies experienced extreme volatility. The importance of PSH has increased in this time due to disrupted food production in some places caused by climate change. At the same time, negotiations for a permanent solution on disciplines on PSH remain at a stalemate at the WTO. IATP contends that buffer stocks are an important policy tool for stabilizing food prices, protecting access to food supplies during emergencies and limiting the effects of price volatility in both local and global food markets. We also discussed the challenges involved in PSH program design and management. Policy makers should be well-informed and careful in designing and managing PSH programs given that there are considerable financial, human and operational costs to their establishment and operation.

Three takeaway findings:

- Food buffer stocks are making a comeback. Developing country governments, as well as some bilateral donor agencies and NGOs, have been investing again in the tool, leading to a resurgence in buffer stocks of rice, maize, wheat and edible oils.

- Regional PSH programs are an interesting option – that allow for cost sharing for low-income countries with limited national resources. Experience with relatively successful regional buffer food stocks, however, including in Southeast Asia (under the auspices of The Association of Southeast Asian Nations [ASEAN]) and West Africa (working with the Economic Community of West African States [ECOWAS]) suggest that investments are needed (human, financial and infrastructure) to improve the design and operability of regional stock programs.

- We see a potential role for farmers and other private sector actors in PSH programs in developing countries with limited public resources. This would need a carefully structured governance framework to manage market power dynamics between large and small producers and traders and to determine what to store, where and how to release stocks.

1. Introduction

This brief discusses lessons learned from recent research on PSH programs in developing countries. We make some recommendations for policy makers intended to improve their design and implementation.

Uncertainty is an integral part of agricultural production, given the sector’s vulnerability to weather variations. While exposure to climate change can be mitigated with more adaptive production systems, it is impossible to completely hedge against all the production shocks that drive food availability and price volatility. Price volatility undermines access to food and causes macroeconomic distortions. All countries face this risk with varying degrees of exposure. Over the years, based on political and economic experience, each country has formulated its own strategy to combat volatility in food availability and prices. Some have developed buffer food stocks, i.e., physical stocking of grains between seasons, while others have built up monetary reserves to finance purchases during a grain emergency. These two options may be limited in low-income countries with limited budgets. Other countries rely on international markets to match demand and supply when domestic production fluctuates. A key objective for all policy makers is to devise an effective and cost-efficient tool to smoothen annual and seasonal fluctuations of food, and thus consumption levels.

There are different types of public food stockholding (PSH) programs, including emergency stocks, buffer stocks and stocks for domestic food distribution. For various reasons, including the failure of PSH authorities to adequately manage supply (and costs), many programs acquired larger stocks than were needed or useful, leading to their being dismantled. Grain buffer stocks in developed countries declined from holding more than 200 million metric tons in the mid-1980s, to less than half that amount today.[1] Most stocks today in developed countries are held by private entities, including farmers, processors and traders, rather than managed by public agencies.

At the same time, after decades of controversy and decline, PSH programs including buffer stocks have been making a comeback in developing countries. This re-emergence of an ancient agricultural distribution tool is noteworthy for four reasons: (i) it fits in a larger trend of governments prioritizing domestic self-reliance and finding ways to reduce dependence on global value chains; (ii) it suggests that (especially low income) net-food importing countries want to reduce their exposure to abrupt international supply shocks to their food supply; (iii) it ignores the now decade-long stalemate among World Trade Organization (WTO) members who have failed to agree changes to the trade rules governing purchases for PSH; and (iv) it suggests that any eventual revision of the WTO rules will need to take account of this resurgence in PSH, which is broader and more complex than is taken into account in the current standoff.

2. Why use PSH?

Governments (and private traders) use buffer stocks as a hedging policy against volatile grain prices. For traders, it helps fulfill contracts without sudden profit losses (though windfalls may be welcome). For governments, a sudden rise in prices creates food access problems for consumers and may not help farmers either, if they have no crops to sell. Farmers, especially small and medium-scale farmers, do better in an environment with low volatility and more predictable prices. Typically, the government sets a price band using maximum and minimum prices for grain. Through purchases and sales of grain from the buffer stock on the open market, the government aims to keep the domestic price within its desired price band, avoiding both price and supply instability.

In developing countries, buffer stocks typically target grains that can readily be stored for long periods of time. In recent decades these grains have become central to the diets of low-income households the world over. Buffer stocks do not require the government to forecast future grain prices. Buffer stocks are compatible with a market economy as the government relies on supply and demand to set the price band, which evolves over time as market conditions change. The point is to slow and smooth change, not to lock in unchanging prices. Buffer stocks are also compatible with international trade. They can be used to stabilize domestic prices of grain, which especially in large grain producing and consuming countries, contributes to more stable world prices. Note that if buffer stocks divert grain from export markets, they can also contribute to greater instability on international markets. The size of the stocks, the degree of integration in world markets of the buffer stocking country, and the predictability of the policies adopted to acquire and release stocks will all have implications for the effect on world markets.

This brief builds on previous research by the IATP (2012) in the aftermath of the 2007-2008 food price crisis.[2] That work pointed to the usefulness of PSH as a tool and discussed various challenges that programs face. In our view, interest in PSH programs is likely to increase in the face of climate change rising weather disasters, which are affecting food production and distribution systems. Price volatility is also linked to geopolitical conflict like Russia’s invasion of Ukraine in 2022, and the ongoing war coupled with economic sanctions imposed on Russia by many Western powers, which has cut both countries’ exports of wheat, maize, sunflower oil and fertilizers.

Country contexts are specific, and there is a wide range of possible designs for PSH programs and their management. Stocks are an imperfect tool, blunt rather than precise and expensive if the levels are mismanaged. They can involve significant resource investment, and require administrators that can develop and maintain good, publicly accessible data on production and markets, so the stocks are integrated into the economy. One of the challenges for PSH is that most traded commodities worldwide are controlled by global commodity traders who are famously secretive about their operations and holdings. Other important decisions for PSH design include which crops to stock, distinguishing the management of stocks of commodities that are not traded internationally (for example, millet, plantains and casava), and designing an effective governance framework for a PSH program that works for producers, traders and consumers.

3. The long-stalled WTO negotiations on PSH

Since 2012, the contentious negotiations to find a permanent solution on PSH at the WTO, in particular disagreement between the United States and India, have crowded out discussion on whether and how the WTO Agreement on Agriculture (AoA) is equipped more broadly for a context in which PSH is again more common, especially in developing countries. Disagreements on PSH rules nearly blocked an agreed outcome at the WTO Ministerial Conference in Bali in 2013. In 2014, India and the U.S. agreed to a “peace clause” on PSH that continues to hold sway for all WTO members. That decision exempts existing PSH programs from legal challenges at the WTO (if certain other conditions are met) until a “permanent solution” is achieved. The issue remains unresolved, and neither of the two most recent Ministerial Conference Declarations, in 2022 and 2024, included agriculture (although two outcomes on food security were adopted in 2022).

The argument is not over PSH programs per se but on how the public expenditure in acquiring stocks is counted under the complicated rules in the AoA that govern domestic support. Simply put, as members raised administered prices over the years to keep up with rising food prices in the late 2000s, they faced potential challenges, as support levels for PSH programs threatened to exceed domestic support commitments under the AoA. The AoA, in effect since 1995, caps the total of product and non-product-specific subsidies, or aggregate measurement support (AMS), including for PSH programs, at 10% of the value of agricultural production for developing countries (5% for developed countries). For many developing countries, this cap is much higher than actual levels of spending. However, developing countries like India and the African Group argue that PSH policies are crucial for food security and rural development, and have made the case for more flexible terms under the WTO’s agriculture negotiations. For example, the Fixed External Reference Price (FERP), used to calculate market price support, is based on a three-year average price between the years 1986-1988, and has become outdated as a relevant benchmark against rising food prices and expenditures on food stocks.

In a communication to the WTO Committee on Agriculture dated Nov. 7, 2024 (G/AG/W/250), the U.S., Australia, Canada, Ukraine and Argentina, outlined what they say is India’s improper methodology for calculating its domestic market price support for rice and wheat. They reiterated a long-standing complaint that India has exceeded its WTO domestic support threshold for both rice and wheat. India has at times acknowledged, when invoking the PSH peace clause to protect its stocks program from challenge, that its support for rice exceeded the threshold of 10% of the value of production. Negotiators are currently seeking to move the negotiations on PSH forward ahead of the WTO Ministerial conference in 2025, although current indications are that members continue to be at a stalemate.

4. Recent trends and innovations in PSH programs in developing countries

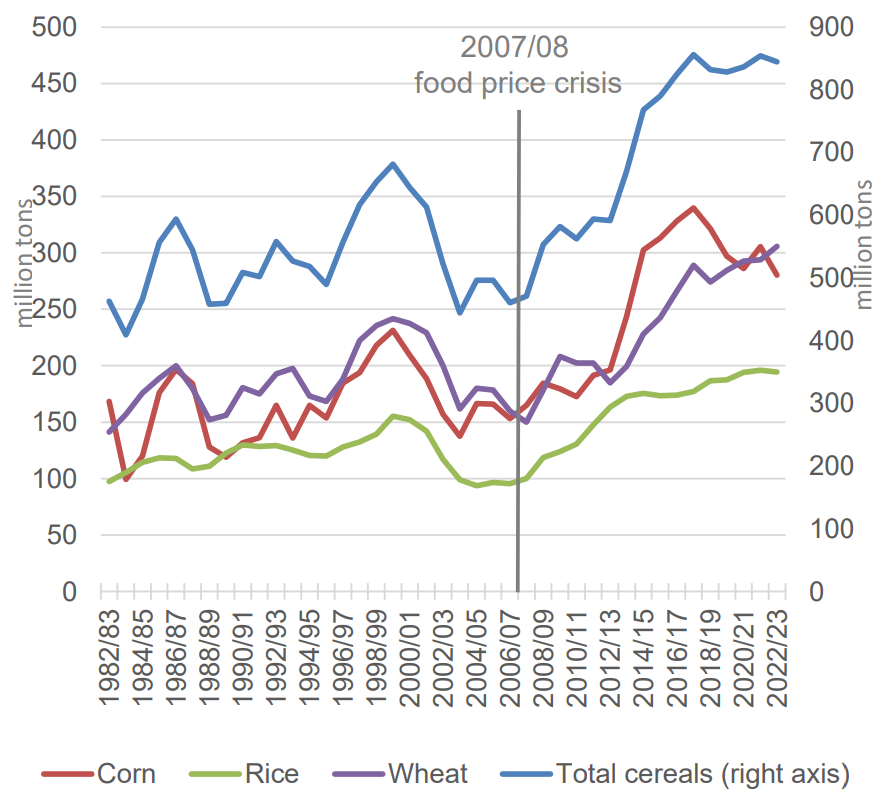

Buffer stocks as a policy tool for managing supply, price stability and food security are making a comeback as illustrated by global food cereal stock trends in Figure 1.[3]

Figure 1: The Evolution of Global Food Cereal Stocks 1982/83-2022/23 (Mn. MT)

Source: Cosimo Avesani, Public food stockholding: policies and practices, FAO Presentation at the WTO Committee on Agriculture, Seminar on Public Stockholding, March 29, 2023

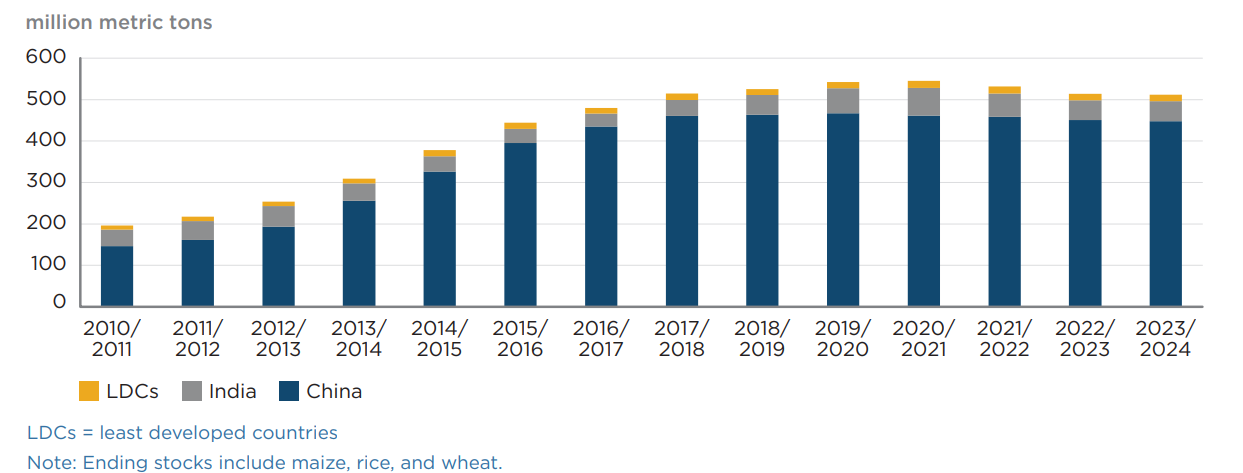

Two-thirds of developing countries, including at least 45 least-developed countries, are both low-income net-agricultural importers and net-food importers. Although food insecurity, coupled with fluctuating domestic production, make the need to stabilize and support food production and consumption most acute in LDCs, the largest stocks are (unsurprisingly) held by the most populous countries, in particular China and India (Figure 2).

Figure 2: Grain stocks held by LDCs compared with China and India 2010-24

Source: US Department of Agriculture, Foreign Agriculture Service, Official USDA Estimates, PSD, Peterson Institute for International Economics. https://www.piie.com/sites/default/files/2023-10/pb23-15.pdf

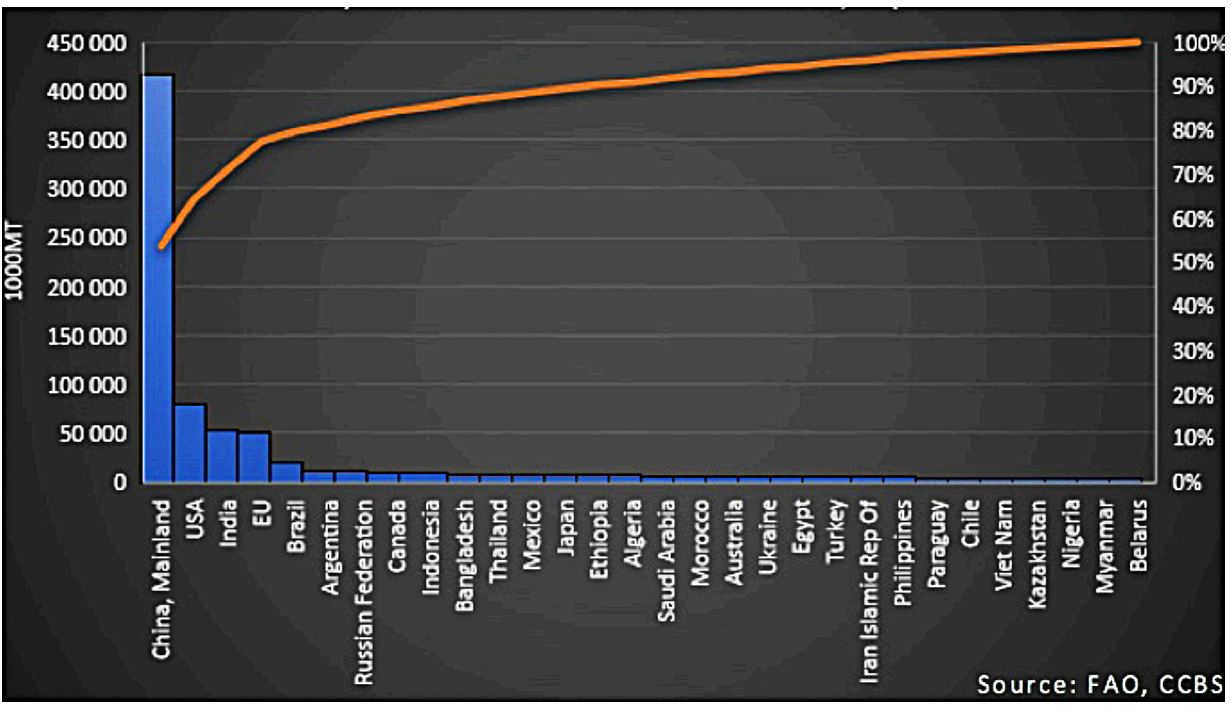

Roughly half of the world’s population lives in countries with active PSH programs.[4] However, most countries, including both developing and emerging economies, hold relatively low levels of stocks (Figure 3). Between two-thirds to three-quarters of global maize, rice and wheat stocks are held by either China or India; nearly three-quarters of reserves are held by just five countries (Figure 3). The concentration of stocks reflects the size of the population in these countries and the fact that they are large producers. In India’s case, the rapid accumulation of very large stocks of rice have turned the country into the world’s largest rice exporter.

Figure 3: The distribution of cereal stocks across countries (2019/20)

In 2023, India – the world’s second largest producer of wheat and rice – announced plans to complete development of the world largest grain storage facilities (3 million –metric ton silo capacity) spread across 196 different locations. The infrastructure will be developed through a public-private partnership led by the Food Corporation of India (FCI), a public corporation, and is expected to cost about USD1.3 billion. On-going expansion is projected to bring India’s storage capacity to 9.4 million metric tons of wheat over the next three to four years, in addition to an existing 40-50 million metric tons of rice stored by FCI under the National Food Security Act (Danley, 2023). This combined storage capacity can hold 47% of the country’s grain output (Danley, 2023).

Some countries have taken a regional co-operation approach to developing their buffer stocks. The South Asian Association for Regional Cooperation (SAARC) upgraded its 1987 Food Security Reserve and replaced it with the SAARC Food Bank – effective since 2013. The first drawdown of SAARC Food Bank reserves (maintained by India) was made by Bhutan in May 2020 to deal with supply constraints during the COVID-19 pandemic.

Trends in Southeast Asia offer some useful lessons for other developing countries and regions on buffer stocks. The region is highly susceptible to climate change damaging the production of its staple food, rice. Southeast Asia has also experienced periodic food supply chain disruptions due to its high dependence on cereal imports. To address concerns about possible shortages, the Association of Southeast Asian Nations (ASEAN) upgraded its 1979 Rice Reserve System by partnering with China, Japan and South Korea in 2012 to form the ASEAN Plus Three Emergency Rice Reserve, known as APTERR. APTERR comprises earmarked rice and physical rice stocks, including emergency reserves, stockpiled reserves of cash and rice, and other reserve forms like future contracts or donations. It operates through a three-tier system, involving commercial contracts, emergency grants and loans, and donated rice for emergencies. The APTERR Agreement imposes binding obligations on parties to commit to specific actions and includes measures for dispute resolution. Members of APTERR have used the agreement a lot, especially in Tier 3 releases, and members have contributed rice in times of crisis to support their neighbors.

In Africa, the Economic Community of West African States (ECOWAS) adopted a regional food security storage strategy in 2012. The strategy has four components, namely: (i) local stocks managed by producers’ and breeders’ organizations; (ii) national stocks managed by the countries; (iii) regional stock; and (iv) the recourse to international aid. The strategy is based on a physical stock and a financial reserve, which is held by the ECOWAS Regional Fund for Agriculture and Food (RFAF). Governments’ commitment to the program is evident in their deployment of institutional, human and financial resources and has been critical for the successful operationalization of this strategy. Under Pillar (iii) of the strategy, ECOWAS established the ECOWAS Regional Food Security Reserve in 2013, which is supported by European Union, the French Development Agency (AFD), the Spanish Cooperation (AECID), USAID and the World Bank. Local storage entities have adopted a charter committing them to good stock management practices and enabling contractual relations with the member states. Local storage entities include both public and private players such as farmers organizations (including, cooperatives and feed banks); industrialists who process cotton, groundnuts, palm, palm kernels, etc. and market oilcake; food manufacturers (especially millers); rice processors; livestock feed manufacturers; the brewing and sugar industries. The entities are a mix of relatively structured operators and small-scale operators.

At the ECOWAS level, the Regional Reserve is committed to transparency. The Regional Reserve has a physical capacity of 42,000 metric tons of cereals at any given time, stored in the warehouses of national storage bodies. The Regional Reserve has intervened 19 times since 2017, in support of six countries in the region (Burkina Faso, Cabo Verde, Ghana, Mali, Niger and Nigeria) for a combined total of more than 55,000 metric tons of cereals.

Challenges remain. The mechanisms for regional pooling of 5% of national stocks within the framework of the Network of Public Companies in charge of the Management of National Stocks (RESOGEST), have been slow meeting the expected reserve target amounts. Between USD1.2 billion and USD2 billion is required annually to address the emergency food requirements in West Africa; the regional program has not reached this financial goal, and physical stocks are also lower than target levels. Currently, ECOWAS and member countries have been unable to mobilize sufficient financing to bring stocks to targeted levels. The physical stocks are also held too far from the populations who most frequently need them. New risk financing instruments could help secure a stronger financial position and strengthen RESOGEST as an effective, regionally owned vehicle that minimizes the need for expensive and ad hoc food emergency responses.

Across Africa, countries investing in building buffer stocks include Algeria, Egypt, Rwanda and Zimbabwe. In 2024, Egypt (which is Africa’s largest grain importer) reported its plan to build a new USD153 million grain storage facility with capacity to handle 6 million metric tons of grain each year in the Suez Canal Economic Zone. This is just under a third of the country’s recent total cereal import requirements, which were about 20 million metric tons in the 2023-2024 agriculture marketing year. In 2024, Algeria, which is Africa’s second largest importer of cereals after Egypt, announced the relaunch of its agri-food complex in the city Corso, just east of Algiers, following 21 years of inactivity. The government said this was in response to its increasing demand for cereal imports. The government aims to triple cereal storage capacity from 3.4 million metric tons to 9 million metric tons by 2025, against a projected demand for cereal imports of 14.1 million metric tons for the 2024-2025 period.

In 2021, FAO published an inventory of buffer stock programs globally.[5]The report noted that in many cases, meeting the multiplicity of objectives and functions assigned to buffer stocks can be challenging. Buffer stock programs that aim to provide both high prices for producers and low prices for consumers often end up achieving only one goal at the expense of the other, or neither. There are also challenges with management capacity and coordination with multiple stakeholders, which means the PSH authorities fail to reach their target consumer populations. Other PSH authorities were found to have calculated procurement and price interventions poorly, which had the perverse effect of increasing market uncertainty and price destabilization.

Some of the initiatives highlighted above are relatively new. It remains to be seen how effective they will be in meeting their stated objectives. For some low-income countries, the current investments are too small, pointing to the need for additional (and innovative) financial support possibly through development partners. Many countries are investing in increased buffer stocks and infrastructure in parallel with renewed investment in domestic food production. Many governments want to reduce their dependence on food imports to help mitigate the risk of supply and food price volatility from international markets such as they experienced in recent years. These are noble objectives which could develop into effective PSH programs to manage price stability if coupled with well thought-out interventions to purchase, hold and sell stocks.

5. Complementary Services: Getting the most out of a PSH

Successful PSH programs require sound trade policy and timely and adequate data for policy makers to know when to adjust prices or make grain purchases and sale. The physical quality of the stocks also needs to be monitored. Improving the quality of stock data has been the focus of organizations like the Agricultural Market Information System (AMIS).

In a complementary service, the ASEAN Food Security Information System (AFSIS) provides a platform for sharing accurate and timely information concerning the state of stocks, consumption, grain trade, market trends and food security in the region for five major food crops: rice, maize, soybean, sugarcane and cassava. It also provides data on planted and harvested areas, production, yield, crop calendar, wholesale price, the labor force in agriculture, trade, GDP, food balance sheet, land use and cost of production. AFSIS also publishes the ASEAN Agricultural Commodity Outlook (ACO) and the Early Warning Information (EWI) reports.

The Agricultural Market Information System (AMIS)

AMIS is an inter-agency platform to enhance food market transparency, dialogue and policy response for food security. It was launched in 2011 by the G20 Ministers of Agriculture in response to the global food price hikes in 2007-2008 and 2010. It brings together the major trading countries of agricultural commodities. AMIS examines global food supplies (wheat, maize, rice and soybeans) and offers a platform to coordinate policy action in the event of market uncertainty. It also helps develop technical and institutional capacities for governments to collect market information and improve data quality. To reduce data discrepancy more work is needed on collecting data on privately held stocks. AMIS includes G20 members plus Spain and eight additional major exporting and importing countries of agricultural commodities – cumulatively accounting for 80-90% of global production, consumption and trade volumes of the targeted crops. Improved transparency and policy coordination in international food markets with support from AMIS has helped to mitigate unexpected price hikes and strengthen global food security.

6. Conclusion - Lessons for supporting PSH programs in developing countries

Buffer stocks are a useful tool for managing price volatility and safeguarding food security. The costs of market failure and food disasters are huge, exceeding the cost of most reserves. Three proposals stand out: (i) buffer food stocks are making a comeback among developing countries; (ii) experience in regions like ASEAN and ECOWAS shows that regional stock programs are a viable option for building buffer stocks in low-income countries with limited national resources; and (iii) we see potential for an enhanced role for farmers and other private sector actors in PSH programs for developing countries that have limited public resources. This could be achieved through public-private partnerships, with a carefully structured governance framework to manage market power dynamics between large and small producers and traders and regulate what to store, where and how to release stocks.

We also highlighted some buffer stock trends. While PSH programs are prevalent across all regions, there is a diversity of PSH instruments that countries use.[6] Countries tend to have diverse production and trading structures with many countries procuring stocks domestically at administered prices with further differences in how they dispose stocks (FAO, 2021). Some dispose stocks through aid programs directly targeting beneficiaries, others sell stocks from government storage facilities using regulated prices direct to processors and/or retailers; and yet others release stocks on markets depending on the prevalent domestic market price (FAO, 2021). There are also differences in how countries set and administer prices, and the way that domestically procured stocks are complemented by imports or imports are restricted. Generally, administered prices for maize, wheat and rice have been increasing in nominal values, but inflation and exchange rate fluctuations may have impacted gains for producers and could also mean that procurement prices were below indicative international prices.

Buffer stocks are important for stabilizing prices and to provide food security cover during emergencies and volatility on global food markets. However, we are also mindful of the challenges involved in the design and management of PSH programs. We highlighted the dearth of research and the problem of obtaining accurate data on PSH programs and expenditure. Improved data collection and transparency in stakeholders declaring information about stocks (above a certain size) are critical requirements for effective policymaking and management of PSH programs. Tools like AMIS can play a supporting role in this regard. Historically, the effectiveness of buffer stocks in stabilizing prices is mixed. Buffer stocks can also disrupt international markets, especially if their governance is not transparent.[7] Many PSH programs eventually fail, even if they are initially successful for a time. Experts attribute the failures to several causes, including the lack of clear objectives, failure of the stock program administrators to respect operational rules regarding the price at which to purchase and sell grain, or their mismanagement of physical stocks. This includes corrupt practices. Physical storage of agriculture commodities requires sound storage conditions to protect the value and quality of the grain. PSH programs can create challenges beyond national borders. For example, the build-up of food stocks in recent years by some of the most populous countries like China, India and Indonesia, has been blamed for causing rising global food prices. PSH programs can also produce internal policy contradictions. For example, amid speculation about a wheat shortage, in June 2024, India responded with a cap on wheat stockholding limits for retailers and processors (effective until March 31, 2025) to curb food price volatility, speculative pricing, prevent hoarding, and to manage supply and stabilize prices in the market. This measure is in addition to India’s existing export bans on wheat, rice, and sugar. These developments illustrate some of the challenges in managing PSH programs to meet both domestic and external trade concerns.

There are considerable financial, human and operational costs to establishing and maintaining PSH programs. Where effective governance systems for operational management of PSH programs are not fully developed, this can result in financial losses or cause price and trade distortions, causing the very problems that PSH programs seek to solve. An earlier study of PSH looking at India, Indonesia, the Philippines and Zambia, estimated the costs of a PSH programs to range between 0.5% to 1.5% of GDP in different years.[8] These include costs of procurement, storage, release, and distribution of stocks, but also inefficiencies in management of PSH programs which can compound the costs.

We have also witnessed the return of earlier ideas on buffer stocks with some modifications – with a focus on building international, regional, national and community level. Some experts propose that to address future volatility, the existence of strategically located physical buffer stocks would safeguard countries from such supply disruptions.[9] They propose that these buffer stocks could be managed by the UN Food and Agriculture Organization (FAO) or another UN body specifically established for this purpose, or by national governments that undertake to release stocks according to an agreement. Physical reserves could be augmented with “virtual reserves,” whereby participating governments under an agreed framework arrangement and following the advice of a coordinating agency, would intervene in financial markets to mitigate price manipulations by speculators such as strategic short selling in futures markets.

Some food importing regions like West Africa and ASEAN have experimented with coordinated regional approaches to building buffer stocks with some success. The question is whether such a regional approach would help address volatility, food insecurity and increase grain trade in vulnerable regions like East Africa (and the Horn of Africa). Such regions would need support from development partners to overcome supply and cost challenges, and possibly use a combination of physical, virtual, private and publicly held stocks as well as boosting reserves at community and household levels in rural areas.

Effective PSH programs require efficient infrastructure and distribution channels to transfer the released stocks to the targeted population. An earlier study looking at emergency reserve systems in Africa (Rashid and Lemma 2011) found considerable diversity between countries, with costs ranging from USD20 to USD46 for storing a metric ton of food, depending on institutional design, location, appropriateness of the stock size and the level of integration with other transfer and social protection programs. Policy makers must constantly look at ways to potentially lower costs, which include the option of including private entities to help store and release stocks. This has been achieved, for example in Bangladesh’s food reserve system.

Despite the challenges that PSH programs confront, there are several examples of programs that seem to be working effectively. Smaller and targeted strategic reserves as well as regional buffer stocks have demonstrated that they can be a viable and cost-effective option to complement grain trade and improve food security for vulnerable populations. Ultimately, PSH programs require sound management and flexibility, good quality information and infrastructure, compliance with rules and procedures, and mechanisms to adjust reserves to needs and the market. As best practice, we recommend that countries should engage in greater information exchange and learning. This should be coupled with greater transparency in stock levels and predictability in procurement and sales.

Download a PDF of this policy brief.

Bibliography

[1] Agricultural Market Information System of the G20 (AMIS). (2021). Grains Storage and Global Food Security. https://www.amis-outlook.org/

[2] Institute for Agriculture and Trade Policy. Editors: Ben Lilliston and Andrew Ranallo (eds). 2012. Grain Reserves and the Food Price Crisis: Selected Writings From 2008–2012. https://www.iatp.org/sites/default/files/2012_07_13_IATP_GrainReservesReader.pdf

[3] Isabella Weber, Merle Schulken, Lena Bassermann, Lena Luig and Jan Urhahn. 2024. Buffer Stocks Against Inflation: Public Food Stocks for Price Stabilisation and their Contribution to the Transformation of Food Systems. Heinrich-Böll-Stiftung, Rosa Luxemburg Foundation and TMG Research gGmbH (TMG). https://us.boell.org/sites/default/files/importedFiles/2024/06/25/policy-paper-buffer-stocks-against-inflation.pdf

[4] Alan Wm. Wolff and Joseph W. Glauber. Food insecurity: What can the world trading system do about it? Peterson Institute for International Economics, Policy Brief 23-15, October 2023 https://www.piie.com/sites/default/files/2023-10/pb23-15.pdf

[5] FAO. 2021. Public food stockholding – a review of policies and practices. Rome. https://doi.org/10.4060/cb7146en

[6] Cosimo Avesani. Public Food Stockholding: Policies and practice. Presentation to the WTO Committee on Agriculture, Seminar on Public Stockholding, March 29, 2023. https://www.wto.org/english/news_e/news23_e/agri_31mar23_pres3_e.pdf

[7] For example, Brooks and Matthews (2015), reference a World Bank review (2012) of national and regional experiences which concluded that while buffer stocks could contribute to addressing short-term emergency requirements, they were less effective as an instrument to stabilize prices. Similarly, a report by international organizations to the G20 (2011) rejected the use of buffer stocks to stabilize prices as costly and ineffective, although it did see a role for small-scale food security emergency reserves to assist the most vulnerable. Brooks, J. and A. Matthews. 2015. Trade Dimensions of Food Security. OECD Food, Agriculture and Fisheries Papers, No. 77, OECD Publishing, Paris. http://dx.doi.org/10.1787/5js65xn790nv-en

[8] World Bank. 2012. Using public foodgrain stocks to enhance food security. Economic and Sector Work. Report Number 71280-GLB. Washington, DC., The World Bank

[9] Carola Binder. Buffer stocks for price stability? Brookings, October 11, 2024. https://www.brookings.edu/articles/buffer-stocks-for-price-stability/