The U.S. dairy industry is currently threatened by a global dairy glut. Worldwide, milk production has increased nearly 40 percent since 1995, with the fastest increase occurring in the last two years.1 In the United States, dairy output exceeded 157 billion pounds in the first three quarters of 2015, and likely broke all-time production records for 2015 as a whole.2

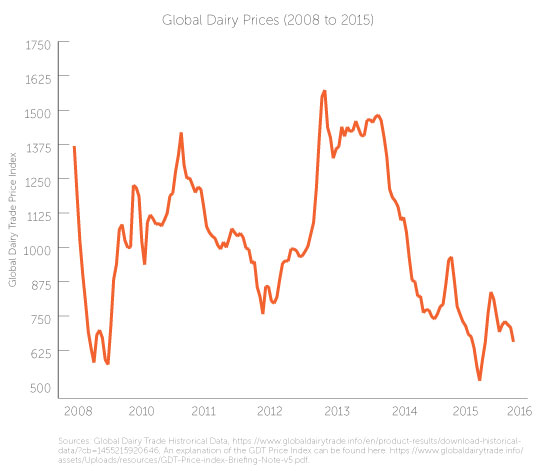

As a result of this oversupply, global dairy prices have plummeted 55 percent since their peak in 2014, and are now at their lowest levels since 2009, according to data from Global Dairy Trade.3 According to Bloomberg Business, in early 2015, dairies in the northeastern United States dumped 31 million pounds of milk when processors could no longer accommodate the supply.4

This crisis of global oversupply and crashing prices reflects a deeper crisis for U.S. dairy farmers: the hollowing out of the industry itself. According to data from the USDA, the number of U.S. dairy farms declined from 648,000 in 1970 to 75,000 in 2006.5 Today, fewer than 60,000 dairy farms are active in the United States.6 Those family farmers who remain face the prospect of years of devastating losses and cutbacks due to governments’ and market actors’ inability or unwillingness to realign demand and supply nationally and globally.

The False Hope of the TPP

In the present context of crashing dairy prices and failing farms, the Office of the U.S. Trade Representative continues to argue that the Trans Pacific Partnership (TPP) agreement will be a savior for U.S. agriculture. The agreement, soon to be considered for approval by Congress, would reduce or eliminate tariffs on dairy products across the board.7 “U.S. agriculture, as a whole, has a lot to gain from this agreement,” contends Darci Vetter, chief agricultural negotiator for the USTR, because the deal’s tariff cuts promote exports, and exports are the key to growth.8

Yet despite these confident claims by the USTR, the prospects of export-driven growth in the U.S. dairy industry appear dim. U.S. dairy exports fell by 33 percent in value and 13 percent in volume over the past year alone.9 Many of those exports had been flowing to China, where growth has now stalled, ending the global commodity boom for the foreseeable future.10

The U.S. dairy industry’s export problems are compounded by similar gluts in other countries. New Zealand (home to Fonterra, a national dairy cooperative that handles one third of global dairy trade and is the world’s largest dairy exporter11) is facing a similar crisis of oversupply and is also looking to snap up export markets.12 In short, U.S. dairy exporters face sharp competition and shrinking markets for exports, negating any projected benefits TPP would bring.

Since the advent of the North American Free Trade Agreement, the agricultural trade performance of six trade agreements has added $1.6 billion to the U.S. trade deficit, not a huge amount but far from the salvation through trade promised to farmers and ranchers by agribusiness trade promoters.13 As ever, what protects farmers from below cost of production prices for grains and oilseeds are taxpayer-funded safety nets and government programs, such as corn-based ethanol mandate in the Renewable Fuel Standard14 to support prices, not the exports and imports that benefit a small number of traders and processors. (This analysis does not attempt to estimate the environmental and public health costs of maximizing agricultural production for exports.)

A Realistic Assessment of TPP’s Impact on U.S. Dairy

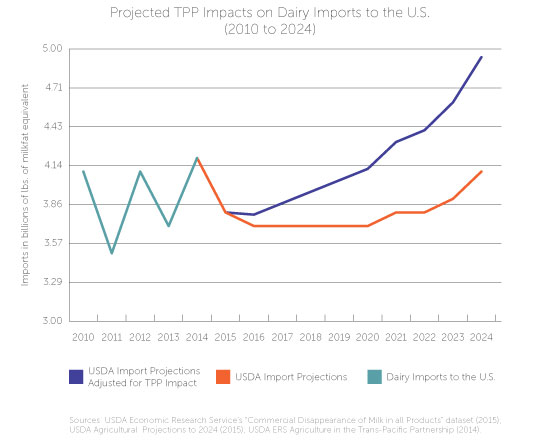

While TPP’s alleged benefits (enhanced export opportunities) are likely to be illusory or marginal at best due to the reasons cited above, the agreement’s impact on imports will be striking. According to USDA projections, the TPP would increase dairy imports to the U.S. by as much as 20.5 percent by the year 2025.15 The figure below illustrates this impact by merging historical dairy import data with USDA projections of TPP and non-TPP scenarios.

In other words, at a time when dairy prices are at historic lows and American farmers are dumping milk out of desperation, the TPP would place U.S. farmers in competition with more cheap foreign dairy imports. A large proportion of these imports would consist of Milk Protein Concentrate (MPC), a powder distilled from whole milk that is used as an additive in processed dairy products, and casein, another processed dairy-protein that was originally used in the production of paints, cosmetics and plastics before manufacturers found uses for it in processed cheeses.16 (Casein is classified as a starch in the Harmonized Schedule of Tariffs,17 and so is not counted in the TPP dairy import projections.)

Although the Food and Drug Administration has never determined MPCs to be Generally Recognized As Safe to eat, they nevertheless are an ingredient in countless U.S. food products, including ice creams, cheeses, frozen pizzas and energy drinks.18 A U.S. Dairy Export Council report attributes the more than six-fold increase in global MPC production between 2000 and 2012 not only to its cheaper price but to “favorable tariff classifications” and “flexible labeling rules.”19

If TPP were approved, the resulting influx of cheap, processed foreign dairy products and ingredients would further undermine U.S. dairy farmers. Prices would continue to bottom out, farms would continue to fail, and more and more of the industry would fall into the hands of large agribusiness. In fact, the only clear beneficiaries of the dairy-related components of the TPP would be the large corporate buyers of dairy ingredients, such as Kraft and Dean Foods Co.20

Conclusion

Realigning supply and demand in global dairy markets requires sensible supply management at the national level, not more trade liberalization. Towards this objective, the TPP would constitute a step backward for U.S. dairy farmers, further embedding them in volatile global supply chains and leaving them vulnerable to markets over which they have no control.

Endnotes

1. Einhorn, Bruce, Dairy Farmers at the Barricades, Bloomberg Business, September, 2015, http://www.bloomberg.com/news/articles/2015-09-10/milk-surplus-dairy-farmers-at-the-barricades.

2. US Quarterly Milk Production and Related Data, USDA Economic Research Service, 11/25/2015.

3. Trading Events Historical Data, Global Dairy Trade, 2016, https://www.globaldairytrade.info/en/product-results.

4. Mulvany, Lydia, The US Is Producing a Record Amount of Milk and Dumping the Leftovers, Bloomberg Business, 7/1/2015, http://www.bloomberg.com/news/articles/2015-07-01/milk-spilled-into-manure-pits-as-supplies-overwhelm-u-s-dairies.

5. Changes in the Size and Location of US Dairy Farms, USDA Economic Research Service, 2006, http://www.ers.usda.gov/media/430528/err47b_1_.pdf.

6. Dairy Facts, Food and Education Network, Purdue University, 2008.

7. TPP Final Text Tariff Elimination Schedule, USTR, 2016, https://ustr.gov/sites/default/files/TPP-Final-Text-US-Tariff-Elimination-Schedule.pdf.

8. Fatka, Jacqui, Ag Support for TPP Remains Strong, Feedstuffs, January, 2016.

9. Dougherty, Carter, US Farm Economy: How Globalization Soured Milk Market for American Dairy Farmers, International Business Times, 2015, http://www.ibtimes.com/us-farm-economy-how-globalization-soured-milk-market-american-dairy-farmers-2117656.

10. Ibid.

11. Weiss, Ben, World’s Largest Dairy Exporter, Soon on Sale, MarketWatch, 2012, http://www.marketwatch.com/story/worlds-largest-dairy-exporter-soon-on-sale-2012-03-06.

12. Dickwell, Jim, World Glut of Milk being felt in Canada, Ireland, New Zealand, AgWeb, 2016, http://www.agweb.com/article/world-glut-of-milk-being-felt-in-canada-ireland-new-zealand-naa-jim-dickrell/.

13. Harwood Schaffer and Daryl Ray, “Trade Effects of bi-lateral trade agreements on U.S. agriculture,” Agricultural Policy Analysis Center, December 31, 2015. http://www.agpolicy.org/weekcol/804.html.

14. Schaffer and Ray, “Question: what makes crop agriculture fly so high and then crash so quickly?” Agricultural Policy Analysis Center, January 29, 2015. http://www.agpolicy.org/weekcol/808.html.

15. Agriculture in the Trans-Pacific Partnership, USDA Economic Research Service, 2014http://www.ers.usda.gov/media/1692509/err176.pdf.

16. Jesse, Ed, US Imports of Concentrated Milk Proteins: What We Know and Don’t Know?, UW Madison, 2003, http://www.fda.gov/ohrms/dockets/dockets/00p0586/00p-0586-bkg0001-62-Ref-60-Jesse-vol25.pdf.

17. Ibid., at 2.

18. http://www.fda.gov/Food/IngredientsPackagingLabeling/GRAS/NoticeInventory/ucm427497.htm; Pete Hardin, Protein Imports Disrupt U.S. Dairy Markets, Weaken Producers,” The Milkweed, May 2012, and Food and Water Watch, “Milk Protein Concentrates”,http://www.foodandwaterwatch.org/sites/default/files/Milk%20Concentrate%20FS.pdf.

19. Hasmukh Patel and Sonia Patel, “Milk Protein Concentrates: Manufacturing and Applications,” U.S. Dairy Export Council, 2014, at 3-4. http://www.usdairy.com/~/media/usd/public/mpc_tech_report_final.pdf.

20. Mulvany, Lydia (cited above).