Executive Summary

Our global food system contributes a third of global greenhouse gas (GHG) emissions, while GHG emissions occurring on farms account for nearly half of that. Curbing these emissions is a prerequisite to avoiding the worst effects of the climate crisis, though the sector has only recently started to receive attention from regulators.

Agriculture and food companies play a large role in shaping how and what we produce and eat. Governments and private actors have started emphasizing the role of agri-food supply chains in addressing the climate crisis, recognizing that companies need to be held accountable for the impacts of their business model in their supply chains.

Against this backdrop, some companies in the agriculture and food sector on companies claim to be taking action on climate change by launching various programs, partnerships and digital platforms, claiming to support farmers in transitioning to more sustainable practices while cutting their supply chain emissions. But are they delivering?

This report examines the strategies of 14 meat and dairy companies and four agricultural input companies supplying fertilizer, pesticides, seeds and feed, focusing on two elements: the potential to deliver genuine emissions reductions and the support provided to farmers to make this transition happen. While not exhaustive, this selection offers a cross-section of industry practices. Farmers will be the ones implementing most of the measures needed to cut emissions. Yet their needs and concerns are often overlooked in the analysis of agribusiness climate plans, a gap which this report seeks to remedy.

Our analysis found that:

- Meat and dairy companies are increasingly focusing on climate action within their supply chains, but the closeness of their relationship with their suppliers varies. This opens up the possibility that the same on-farm GHG emission reductions are claimed by multiple companies or that actors at different points in the value chain co-claim the same reductions, leading to an overall reduction in ambition.

- While most companies work to some extent with their known direct suppliers, strategies go beyond their supply chain and even their supply shed, blurring the lines with discredited approaches of offsetting corporate pollution with actions taken by others.

- Agricultural input companies are positioning themselves as connectors between farmers and more consumer-facing companies to generate carbon credits; at best, they co-claim the benefits of climate action.

- Agribusinesses are not undertaking the transformational measures needed to reorient their business practices to work within planetary boundaries. Most livestock companies focus on technological fixes with questionable mitigation potential, including feed additives and biogas. These technologies maintain, rather than challenge, industrial livestock rearing.

- Livestock companies and agricultural input companies rely on carbon sequestration in soil and grasslands to reduce the pressure to cut their ongoing emissions, despite the fact that carbon sequestration cannot replace emission reductions.

- Incentive schemes for farmers vary widely in relation to conditions for payments and their comprehensiveness but it is questionable if they will provide the level needed to support the transition.

- Activity-based sustainability premiums models appear to provide more stable support to farmers compared to the other most common approach, results-based payments for carbon credits, though the lack of information hampered the analysis.

- The increase in on-farm data collection raises concerns about further increasing farmers’ dependencies on agribusiness, existing power imbalances, and potential conflicts of interest between as agribusinesses’ build schemes tied to their products.

To achieve a transformation of the agriculture sector and our food system, all stakeholders need to contribute, especially the companies that hold significant power in shaping the system. However, even though some frontrunner companies are implementing new strategies, they are unlikely to drive change at the speed and scale needed.

As governments develop their next set of climate targets, specific targets to achieve absolute emission reductions should be considered for the agricultural sector with a suite of policy measures designed and implemented to ensure these are met. As governments continue to hold corporations accountable for their emissions, it is important to be mindful of how that push trickles down to the farm level and what kind of protection systems for farmers might be necessary.

The transition to a different food and agriculture system is inevitable, but whether the transition will be just and well-managed is not. The challenge lies in creating systems that respect planetary boundaries while ensuring fair livelihoods for farmers and workers.

Download a PDF of the full report.

1. Introduction

Our global food system contributes a third of global greenhouse gas (GHG) emissions, while GHG emissions occurring on farms account for nearly half of that.[1] Curbing these emissions is a prerequisite to avoiding the worst effects of the climate crisis.[2] Notwithstanding this sizable contribution to GHG emissions, except for the attempt to address deforestation driven by agriculture, climate policy has mostly ignored emissions in the rest of the agri-food system.[3] Even in countries where agricultural GHG emissions dominate a country’s GHG emissions profile, efforts to curb them have been lackluster.[4]

It is only in the last few years that this picture has started to change. Governments have started to acknowledge the need for more climate action in the sector, including as part of their official targets under the Paris Agreement.[5] In December 2023, 160 countries agreed to include climate action on agriculture in their next climate targets under the Emirates Declaration on Food and Agriculture.[6] The Food and Agriculture Organization (FAO) is developing a roadmap for the extent of GHG emissions cuts needed to respect both the 1.5 degrees Celsius temperature limit and eliminate hunger, akin to the process taken by the International Energy Agency (IEA) in its trend setting net-zero pathway.[7] While the roadmap recognizes the importance of cutting GHG emissions in the sector, it falls short on addressing one key player in achieving this: global agribusiness.[8]

In other spaces, agriculture and food companies shaping how and what we produce and eat have come under the climate spotlight. Civil society is shining a light on the tactics agribusiness has employed to avoid acting on their climate impact[9] as well as on the full extent of their contribution to the climate crisis. The top five global meat and dairy corporations emit more GHG emissions than the fossil energy giant Shell[10] and the methane emissions from 15 of the largest livestock companies surpass those of Canada or Australia.[11]

Often the largest source of emissions for these companies is not from their own operations, but from their supply chains or due to the end use of their products. The supply chain emissions of food and beverage companies are on average 23 times higher than their operational emissions.[12]

Governments and private actors have started emphasizing the role of agri-food supply chains in addressing the climate crisis, recognizing that companies need to be held accountable for the impacts of their business model in their supply chains. Governments have tried (and in some cases managed) to strengthen requirements for corporations to publish data about their supply chain GHG emissions,[13] while corporate standard setters are developing more stringent guidelines for companies’ climate action within their supply chains.

Against this backdrop, some companies in the agriculture and food sector are trying to present themselves as frontrunners on climate by launching various programs, partnerships and digital platforms, claiming to support farmers in transitioning to more sustainable practices while cutting their supply chain emissions. But are they delivering?

The scale of the challenge is immense: to create food systems that respect planetary boundaries while ensuring fair livelihoods for farmers and workers. A thorough assessment of corporate claims is needed. Do they meaningfully reduce emissions, or are they just another form of corporate greenwashing? Are farmers truly benefiting from these transitions, or are they being used as pawns in corporate sustainability schemes?

This report examines strategies employed by agribusiness to claim emission reductions in supply chains, focusing on two elements — the potential to deliver genuine emissions reductions and the support provided to farmers to make this transition happen. Farmers will be the ones implementing most of the measures needed to cut emissions. Yet their needs and concerns are often overlooked in the analysis of agribusiness climate plans, a gap which this report seeks to remedy.

The transition to a different food and agriculture system due to climate change is inevitable, but whether the transition will be just and well-managed is not.

2. Scope of the analysis

As corporate reporting on climate actions has increased dramatically over the past decade, so have efforts to track and analyze it.[14][15][16] Some of these analyzes have taken a bird’s eye view of the agribusiness sector, focusing on a small subset of companies[17] or specific industry practices, such as approaches to regenerative agriculture.[18] A second, more critical, vein of research has explored the approaches and tactics taken by agribusinesses with respect to their climate action. Such research has repeatedly exposed that what the industry tries to sell as climate “solutions” are, in fact, greenwashing.[19][20][21][22]

This report analyzes recent developments in the corporate agri-food climate strategies, with a particular focus on what companies claim to do to tackle their supply chain emissions. It covers 14 major meat and dairy companies, predominantly in Europe and North America, along with four agricultural input companies whose core business are fertilizer, pesticides, seeds or feed (Figure 1). This analysis relies on the company’s public communication, which at times remain limited and imprecise.

While not exhaustive, this selection offers a cross-section of industry practices, focusing on recent trends and on companies who claim to be taking action on climate change.

The aim of this report is to capture current developments rather than provide a full industry assessment. It seeks to provide a more qualitative assessment to complement other industry tracking reports as well as contribute to the research on corporate accountability.

This analysis centers on two key questions: Do corporate strategies have the potential to achieve real emission reductions, or are they just greenwashing? Are farmers genuinely benefiting from these transitions, or merely being used in corporate sustainability agendas?

We examine the credibility of these strategies by assessing whether companies are taking responsibility for their supply chain emissions, and whether the measures they are supporting can enable transformational change. To explore the potential impact on farmers, we review the financial support they receive and prospective increases in corporate control over farming practices.

Before jumping into the assessment, it is useful to review some of past activities of the agribusiness sector and how the industry started to position itself, including in anticipation of further regulatory scrutiny.

Figure 1: Companies analyzed

| Company |

Headquarters |

Sector |

| Dairy Farmers of America |

U.S. |

Dairy |

| Land O’ Lakes/Truterra |

U.S. |

Dairy, Feed |

| Arla |

Denmark |

Dairy |

| FrieslandCampina |

Netherlands |

Dairy |

| Fonterra |

New Zealand |

Dairy |

| Organic Valley |

U.S. |

Dairy |

| ABP |

Ireland |

Meat |

| Nestlé |

Switzerland |

Dairy |

| Danone |

France |

Dairy |

| Groupe Lactalis |

France |

Dairy |

| Tyson |

U.S. |

Meat |

| Danish Crown |

Denmark |

Meat |

| Vion |

Netherlands |

Meat |

| Tönnies |

Germany |

Meat |

| Nutrien |

Canada |

Agricultural inputs |

| Yara/Agoro Carbon Alliance |

Norway |

Agricultural inputs |

| Corteva |

U.S. |

Agricultural inputs |

| Bayer |

Germany |

Agricultural inputs |

3. Starting from a low bar: A look back at agribusinesses’ track record

Agribusiness — particularly the livestock industry — has been criticized heavily not only for its contribution to the climate crisis and but also for its strategies to deter change. The playbook of the livestock industry has been characterized as a “distract, delay and derail” approach, downplaying the industry’s climate impact, funding research that aligns with their false narratives and influencing government regulation of the sector to make it ineffective.[23]

What the industry tries to sell as answers to its climate problem, have been repeatedly exposed as greenwashing by civil society,[24] think tanks[25] and media.[26][27] This includes examples of artificially inflating the baselines of their climate targets in order to claim much larger greenhouse gas (GHG) emission reductions than what has actually been achieved[28] or co-opting the concept of regenerative agriculture as a smokescreen to maintain the status quo.[29][30]

In addition, livestock companies have long relied on offsetting, such as tree planting projects.[31] Offsetting is generally based on the assumption that paying someone else to reduce or avoid GHG emissions or remove carbon from the atmosphere and storing it elsewhere (Box 1) — in the form of carbon credits — can replace GHG emission reductions in the company’s own business. This allows companies to avoid reducing their own emissions.

Box 1: Emission reductions vs. carbon sequestration

In discussions about climate science and policy in the land sector, it is critical to differentiate between two terms: “emission reductions” and “carbon sequestration.” These two categories are fundamentally different and should play different roles in climate policy.

- Emissions reductions occur when the level of greenhouse gases being emitted to the atmosphere are reduced. For example, when less synthetic fertilizer is applied to crop fields, nitrous oxide emissions from the soils are reduced.

- Carbon sequestration occurs when carbon is taken out of the atmosphere and store it in soils and biomass. The term “carbon removal” is used to describe the broader category of activities, including carbon sequestration, but also technological measures beyond the land sector.

In corporate and governmental net-zero targets, these activities are considered to have an equivalent impact on the climate. In the case of agriculture, this leads to the assumption that, for example, it does not matter if livestock methane emissions are reduced or if carbon is sequestered in soils or grasslands. Both would result in the same emissions total on the balance sheet.

But carbon sequestration and emission reductions are inherently different and are not fungible. This is primarily because carbon sequestration in soils and vegetation can be easily reversed by changing land management practices, or extreme weather events. Different GHG emissions also have different levels of potency and stay in the atmosphere over different timescales.[46]

Offsetting has suffered reputational hits due to numerous scandals involving “phantom credits,”[32] connections to an illegal timber scam,[33] failure to deliver promised climate mitigation[34] and criminal charges due to fraudulent carbon credits.[35]

A 2023 Financial Times article argued that the increased reputational and litigation risk of relying on offsets as a climate mitigation strategy has led to some companies focusing more on their own supply chains. This strategy would distance them from the damaging public debate on offsetting.[36] In this context, the term ”insetting” has gained traction to stand in contrast to offsetting.[a] At least in theory, insetting is supposed to differ from offsetting by focusing on actions within the value chain, whereas offsetting might be unconnected to a company’s business.[37]

Arguably, this development is also an opportunity for agri-food companies. 46% of the offsets traded on the voluntary carbon market rely on forestry, land-use and agriculture.[38] Many of those offsets are sold across sectors, i.e. fossil fuel companies relying on land-based carbon offsets. Claiming that the agri-food sector will need their own carbon offsets,[39] lobby groups like FoodDrinkEurope[40] and the food corporation PepsiCo have argued for “preferential access”[41] to carbon credits from agriculture in the context of an EU carbon certification scheme development. The problems resulting from cross-sector competition for carbon credits is highlighted by Organic Valley, a U.S. dairy cooperative. The company created its own insetting program, paying farmers for verified GHG emission reductions or carbon sequestration,[42] fearing that otherwise farmers would sell carbon credits to someone else.[43][44] If an Organic Valley farmer sells their on-farm GHG emission reductions to a fossil fuel company, Organic Valley cannot claim those reductions for itself without double-claiming. However, allowing agri-food companies to claim offsets can create a loophole for another highly polluting industry.

This development is reflected in the private sector guidelines for corporate climate action, such as those created by the Science Based Targets initiative or the GHG Protocol. Both have discussed the use of offsets as a way to claim emission reductions in supply chains (Box 2).

The debate has also reached public policy. Regulators are slowing beginning to develop climate policies focused on the agricultural sector. For example, the European Union is currently exploring ways to price agricultural GHG emissions. One controversial option being discussed is creating an agricultural GHG emissions trading system. In such a system, farmers, feed and fertilizer producers, or food processing companies and retailers could be required to buy permits to continue polluting. One option could involve agri-food companies buying carbon credits from farmers to contribute to emission reductions and carbon sequestration in the sector, allowing them to claim lower GHG emissions in their supply chains.[45]

Some meat and dairy companies, as well as agrochemical companies, are already responding to these developments by adapting their climate strategies and putting more emphasis on supply chains. The analysis of this report aims to give a general overview of this direction, and what might be the consequences for the climate and farmers.

Box 2: Moving from offsetting to insetting

Achieving the GHG emissions cuts necessary to limit warming to 1.5 degrees Celsius will require a fundamental rethink of business practices for many corporations. Since for food and beverage companies, supply chain GHG emissions are on average 23 times higher than their operational GHG emissions,[47] it is essential that companies not only address the GHG emissions directly under their control but achieve real GHG emission reductions within their supply chains.

Carbon offsetting can be broadly understood as the practice of investing in climate measures elsewhere to claim that one’s own emissions have been compensated. It can be argued that two variants of offsetting have been used by corporate polluters, including agri-food companies. Take the example of a fossil fuel company buying carbon credits from a forest restoration project to claim GHG emission reductions. This practice can be identified as offsetting for two reasons. First, the company’s polluting activities are supposed to be offset by activities taken by a third party elsewhere to reduce environmental harm. The second aspect relates to the fact that offset credits are often from activities that promote the storage of carbon in forests or soils. Here the two aspects being offset against one another are GHG emissions released by the fossil fuel company and the carbon storage in forests or soils which is meant to counterbalance these (see Box 1).

Corporate standard setting organizations, such as the Science Based Targets initiative (SBTi) and the Greenhouse Gas (GHG) Protocol, have been updating their standards in relation to the use of offsets.[48][49] For example, SBTi does not allow the use of offsets unrelated to a company’s supply chain to meet any company climate targets.

The situation becomes less clear when evaluating actions within a company’s supply. Companies may still use carbon sequestration credits to offset its GHG emissions, so long as those sequestration activities take place within its supply chain. To distinguish the fact that the sequestration activity is taking place within the supply chain (say, an agroforestry project on a farm that supplies a livestock company), rather than the traditional case (planting trees to offset a fossil fuel company’s activities), it is referred to as insetting. Yet, as it is still a measure that allows one to avoid cutting the GHG emissions of the principal activity, it retains this characteristic of masking a lack of action which is associated with offsetting.

SBTi’s revision to its Corporate Net-Zero Standard — the results of which are expected in 2025 — may further close the loopholes for offsetting. One option being considered would allow companies to only use carbon credits generated from activities traceable within their value chains that actually reduce emissions, not from activities that sequester carbon.[50] In fact, the term “insetting” is used by others also to describe relying on carbon credits that are supposed to reflect emission reductions within a company’s supply chain or at least within the sector. One example is the company Athian (Box 4) that sells carbon credits from livestock emission reduction technologies.

4. Understanding agribusiness supply chains

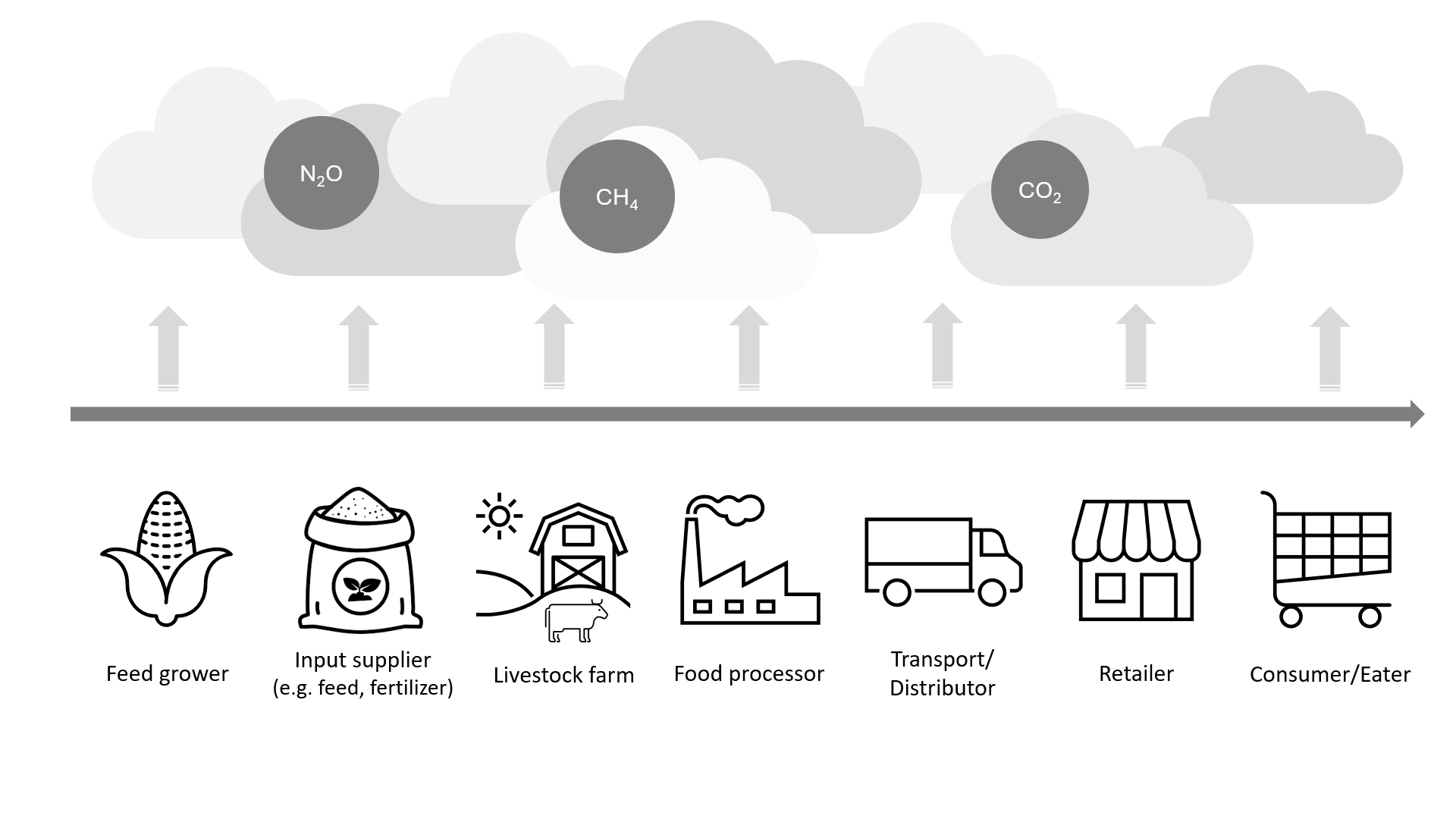

To understand the discussions about climate action within supply chains, it is useful to have a look at what this supply chain looks like. A simplified model of the meat and dairy supply chain illustrates various GHG emissions sources, such as carbon dioxide from synthetic fertilizer production, methane from livestock and their manure, nitrous oxide emissions from feed production, and carbon dioxide emissions from food transport (Figure 2). Feed and fertilizer companies, farmers, meat and dairy processors and retailers are all part of one supply chain.

The idea of corporate climate responsibility is that a company is responsible for the consequences of its actions,[51] including the production of materials used in its own facilities or the impact its products have when being used. Applied to the climate context, a fertilizer company would not only have responsibility for the GHG emissions that result from fertilizer production in the company’s plants but also (at least partially) for the emissions that result from the use of its products. Similarly, a meat or dairy company would be also responsible for the climate impact of the livestock raised for them to sell.

Figure 2: Simplified supply chain for livestock consumer products

There is no one answer to the question of how to assign GHG emissions within a supply chain. One option is to focus on who has the power to make change. Given the current level of corporate concentration in the food system, a lot of power lies with large companies that shape what and how we produce food, as well as what and how we eat. As such, holding companies accountable for the effects of their business beyond the gate of their production facilities is key to achieve change in the sector.

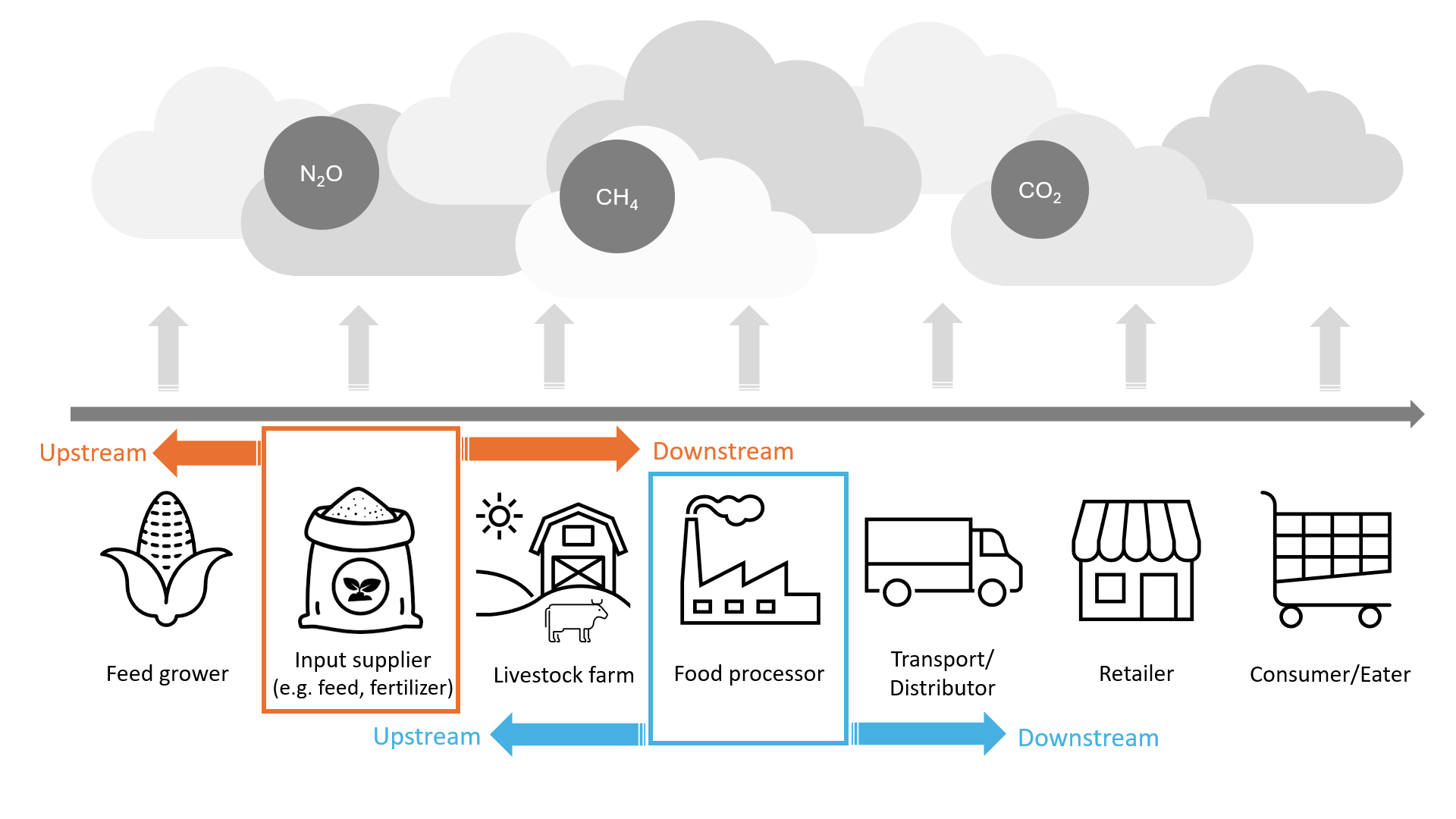

Because different actors share a supply chain, they also share supply chain GHG emissions. For instance, a fertilizer company’s GHG emissions overlap with those of meat producers when the fertilizer was used to produce feed for livestock that was slaughtered and sold by the meat company. Whether GHG emissions are an actor’s upstream, downstream or direct emissions depends on where the actor sits in the value chain (Figure 3).

In reality, supply chains are often not that straightforward and transparent. Farmers might supply more than one company. Companies might know where they buy livestock from but not where the feed comes from and how it was grown. This should not be an excuse to avoid action but provide a valuable background for debates about how corporate accountability should be approached in the development of further legislation and guidelines.

Figure 3: Perspective matters: companies share supply chains and as such supply chain emissions

5. Evaluating agribusiness strategies to tackle supply chain emissions

5.1 Taking responsibility for supply chain GHG emissions?

Evaluating a company’s approach to supply chain emissions requires examining whether its climate strategy directly targets GHG emissions within its actual supply chain.

While it may be possible to distinguish climate measures within and outside of a company supply chain (insetting vs. offsetting) on a conceptual level (Box 2), trying to draw those lines in the real world is challenging as modern supply chains are complex.

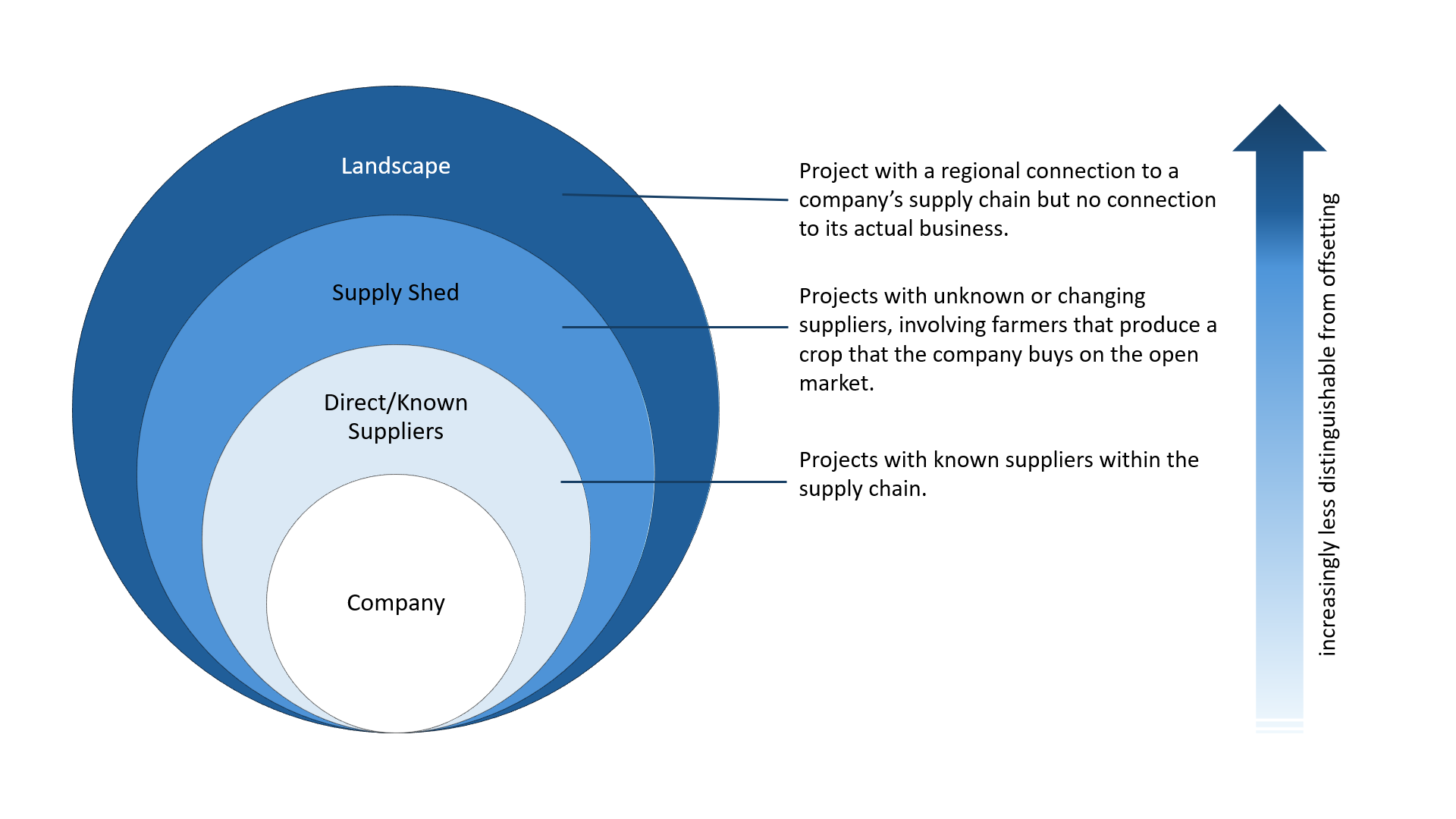

This is further complicated by the fact that proponents of insetting seek to define the concept expansively: a connection may relate to the region in which a company operates, to the products or to key resources on which the company relies.[52] As such, activities would not have to take place directly on the farms that supply a company but through projects in nearby communities or ecosystems.[53] Yet, the further removed a project is from the company's supply chain, the more it resembles traditional offsetting (Figure 4). For instance, a cookstove project aimed at reducing forest overuse can be classified as a typical offset, even if the company sources a crop from that region.

A rule of thumb for evaluating corporate climate strategies is that the clearer it is that a company is working with its suppliers, the more likely it is that a company is committed to rethinking its business practices to work within planetary boundaries. A more direct link between the company and its suppliers/consumers also facilitates the accounting process to ensure that the benefits of climate action are not claimed by more than one actor in the supply chain.

Box 3: Traditional offsetting in corporate climate plans

Traditional forms of offsetting — which are also labelled as such — can be still found in the climate strategies of livestock companies that present themselves as forerunners in the sector (Table 2).* Trying to clarify the role of offsetting in their climate plans, companies like Arla, Friesland Campina and Danone claim that offsets will be a last resort to balance out residual emissions — the GHG emissions remaining after all reduction potentials have been exhausted. However, in most cases it is unclear what scale of emissions would count as such and when all potential is exhausted. Residual or hard-to-abate emissions are terms that take the pressure off polluters to reduce emissions deeply now and for the long-term.[67]

* Even if companies do not publicly communicate the use of offsets to meet their climate targets, that does not mean the company does not use offsets within or outside of the value chain.

Figure 4: The further away a climate project is implemented in relation to the company’s supply chain, the less distinguishable it is from offsetting

Climate strategies target suppliers but the reach beyond might complicate GHG emissions accounting

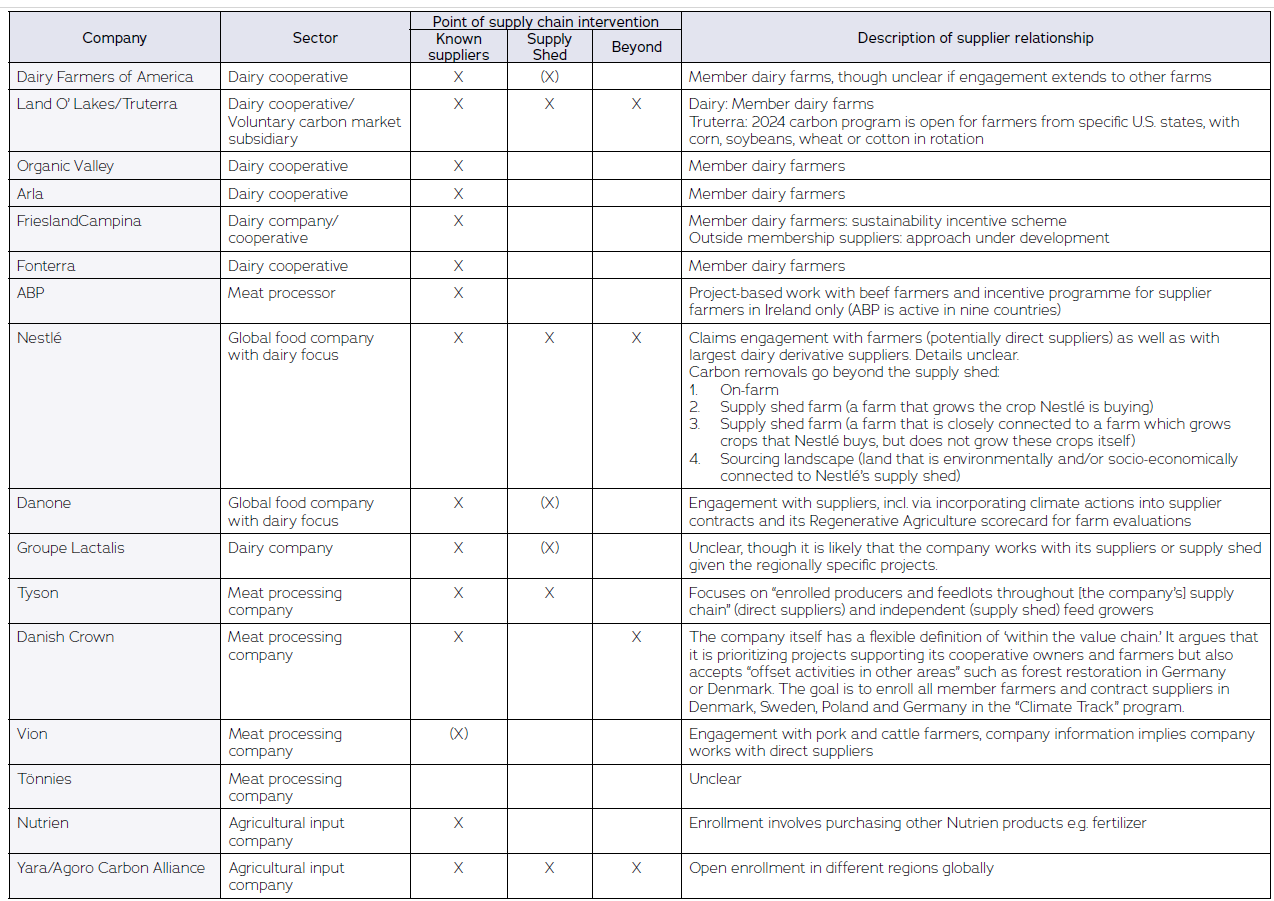

Most livestock companies claim to work with their meat or dairy suppliers, but the level of collaboration varies (Table 1).

Companies like Arla, Fonterra and Friesland Campina, which have a cooperative business model with member farmers, have well-established supplier networks and offer clear incentive programs, such as sustainability premiums for their member farmers. In contrast, companies whose supplier relationships are more difficult to discern from their corporate reporting also provided less information on the nature of their climate activities and where they were located in their supply chains. For some, it was not to specify whether they worked only with known suppliers or with unrelated farms.

Companies with complex supply chains may struggle with tracing the origin of their supplies if, for example, they go through several intermediaries. For that reason, the certification and verification company SustainCERT, which also works with the fertiliser company Nutrien and the U.S. dairy cooperative Organic Valley, requires that companies provide proof that the company has sourced from the specific supplier. If that turns out to be difficult, namely because the suppliers of a company frequently change, they recommend targeting their supply shed instead.[54] A supply shed is a group of suppliers (within a defined geography or market) that provide similar goods and services. For example, if a dairy company knows it sources dairy from a specific region, any farmer that produces dairy in this region belongs to the company’s supply shed, even though it is unclear if this specific farmer’s dairy ends up in the company’s facilities or elsewhere. SustainCERT argues that otherwise the company invests in emission reductions, the company might not be able to claim later. [55]

Dairy Farmers of America (DFA) works with the external certifier Athian to claim GHG emission reductions in their supply chain (Box 4). The company buys carbon credits — certificates meant to reflect a verified number of GHG emissions reductions — from Athian based on manure management, or feed additives that the founding company of Athian sells. The only reported purchase in January 2024 stems from one of DFA’s member farmers in Texas, U.S.,[56] using the feed additive Rumesin.[57] However, it is unclear if the carbon credits generated through Athian would also be available for purchase by other companies or if DFA could buy credits from farmers that do not supply them. Athian’s platform has the potential to facilitate such a crossover in a supply shed and beyond.

In a context where some companies work with known supplier farms and some work with the whole supply shed, it will become increasingly difficult to identify clear ownership of GHG emission reduction claims and could open the door to the same on-farm GHG emission reductions being claimed by multiple companies. The same is true for companies that share at least parts of a value chain, such as a dairy processor and retailer. They would need to co-claim emission reductions, since it affects both of their supply chain GHG emissions. This practice is also controversially discussed in other sectors due to risks counting the same activity twice, consequently lowering mitigation ambition.[58]

Trying to avoid some of this uncertainty, some companies started to add climate targets or mandatory emissions reductions into contracts with suppliers. For example, Danone requires the companies that supply them with dairy (aside from their direct farmer suppliers) to set GHG emission reduction targets of at least the same level of ambition as Danone’s own company targets through its Supplier Engagement Program.[59]

Box 4: Athian: Creating a carbon market for techno fixes

Athian is a U.S.-based company aiming to create an insetting market to certify and trade carbon credits based on emission reductions from the livestock sector. At the moment, it is focused on the use of feed additives.[77] In the future, it may also offer credits based on breeding, herd management, biogas and other manure management strategies.[78] Thus far, livestock carbon credits have had a limited presence in the voluntary carbon market.

The company was co-founded by Elanco Animal Health Inc.,[79] perhaps the most important player on the market for feed additives like Bovaer and Rumesin. These products claim to reduce methane emissions from ruminant livestock. For Elanco, Athian is a way to make the case for its products and to create “a self-sustaining carbon inset market.”[80] The company not only delivers the product that is supposed to achieve emission reductions, but also a GHG emission measurement tool (Elanco’s UpLookTM tool) and a carbon credit marketplace.[81] Several livestock companies have invested in Athian, including California Dairies and Tyson.[82] Currently, the company states that around 150 farms are enrolled in their system, receiving about 20 USD per dairy cow annually. Half of that payment comes from the marketplace, half from government incentives.[83]

Activities beyond the supply chain blur lines with offsetting

For two livestock companies, Nestlé and Danish Crown, it is clear that their climate strategies rely on projects beyond their supply shed even though both companies claim that they do not rely on (traditional) offsets to reach their climate targets.[60][61]

The multinational food company Nestlé is among the first companies to use the term insetting to describe the use of carbon sequestration in the 2021 version of its Net Zero Roadmap.[62] The roadmap was updated since then and no longer mentions the term ”insetting." It now claims to focus on climate action within its supply chain to meet its net zero target.[63] However, its guidance on carbon removals splits projects into four categories, stating that all would count as within the company’s supply chain. Their projects are categorized as: 1) on-farm with known suppliers; 2) a supply shed farm; 3) farms that do not produce an ingredient that Nestlé buys but is close to a farm Nestlé buys from; 4) the “sourcing landscape,” defined as land that is environmentally and/or socio-economically connected to Nestlé’s supply shed.[64] Neither the farms producing other crops or the landscape category belong to Nestlé’s supply chain. In fact, they are hardly distinguishable from typical offsetting.

The pig producer Danish Crown has a similarly blurry definition of within the value chain in its insetting policy. The company states that it is prioritizing projects supporting its cooperative owners and farmers, but it also accepts “offset activities in other areas” such as forest restoration in Germany or Denmark.[65] While Danish Crown has operations in these countries, forest restoration in these areas has little do with the company’s actual supply chain emissions.

These blurry definitions allow companies to hide offsetting behind new concepts. The industry group, International Platform for Insetting, tries to legitimize this approach stating that “on-farm activities are often relatively small-scale” and the carbon credits that can be generated from the surrounding ecosystem often have a much larger potential.[66] This logic allows companies to claim emission reductions more easily than substantively changing their business model, while distancing themselves from offsetting.

Agricultural input companies act as intermediaries between farmers and food companies

Companies providing inputs for agricultural production — such as fertilizer, pesticides, seeds or feed — are positioning themselves as intermediaries to facilitate climate action taken by others. They are leveraging their relationships with (but not limited to) their farmer customers to generate carbon credits, which are then sold to, for example, companies in the meat and dairy sector. They approach farmers producing cash crops, including those used for feed, to implement practices that cut emissions or store carbon in the soil. They certify these results and sell them in the form of carbon credits to the companies that want to claim GHG emission reductions in their supply chains.

Some input companies work directly with downstream meat and dairy producers. Pesticide company Bayer has partnered with Perdue, a U.S. poultry and pork processor, to work with farmers supplying corn and soybeans to Perdue to reduce the meat processor’s supply chain GHG emissions.[68][69] Farmers are signed up to use Bayer’s digital carbon footprint calculator, and encouraged to adopt practices like no-till agriculture and cover crops to decarbonize Perdue’s upstream value chain. Perdue uses the data collected by Bayer to pay farmers for adopting these practices.[70] Canadian fertiliser company Nutrien works with the Canadian meat packer Maple Leaf Foods and verifier SustainCERT to certify emission reduction from fertiliser management. Nutrien enrolls Canadian farmers in its supply chain into the company’s carbon credit program.[71] These credits are meant to reflect reduced emissions of the feed used for Maple Leaf Foods’ pork production.[72] Similarly, Truterra, the voluntary carbon market division of U.S. dairy and feed producer Land O’Lakes, frames itself as a connector between farmers and companies looking to buy carbon credits, in particular for food and fiber companies.[73]

By trying to establish themselves as facilitators, agricultural input companies are able to deflect some responsibility away from themselves for the emissions caused by producing or using their products. The input companies analyzed tend to have fewer and less comprehensive climate targets compared to the livestock companies. The commitment for the Science Based Targets initiative of two companies, Nutrien and Corteva, was removed (Table 3) because the companies failed to submit targets with in the 24-month deadline of the initiative.[74]

Where these companies move beyond a facilitation role, they may be co-claiming the benefits of climate action. In Nutrien’s partnership, both the meat packer and Nutrien appear to claim the emission reductions from modified feed production practices.[75][76] Land O’Lakes does not disclose if, for example, its dairy division relies on the carbon credits certified by Truterra to meet its own climate targets.

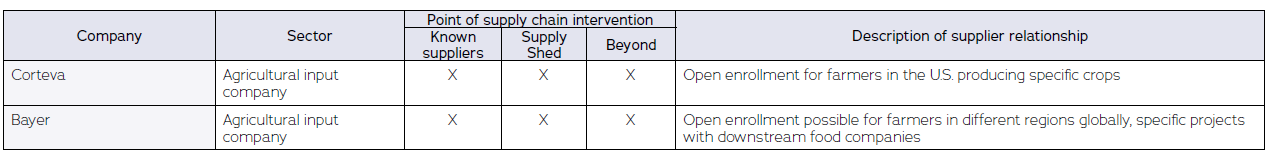

Table 1: Point of supply chain intervention of the company’s emission reduction efforts beyond its own operations.

See Annex for Table references.

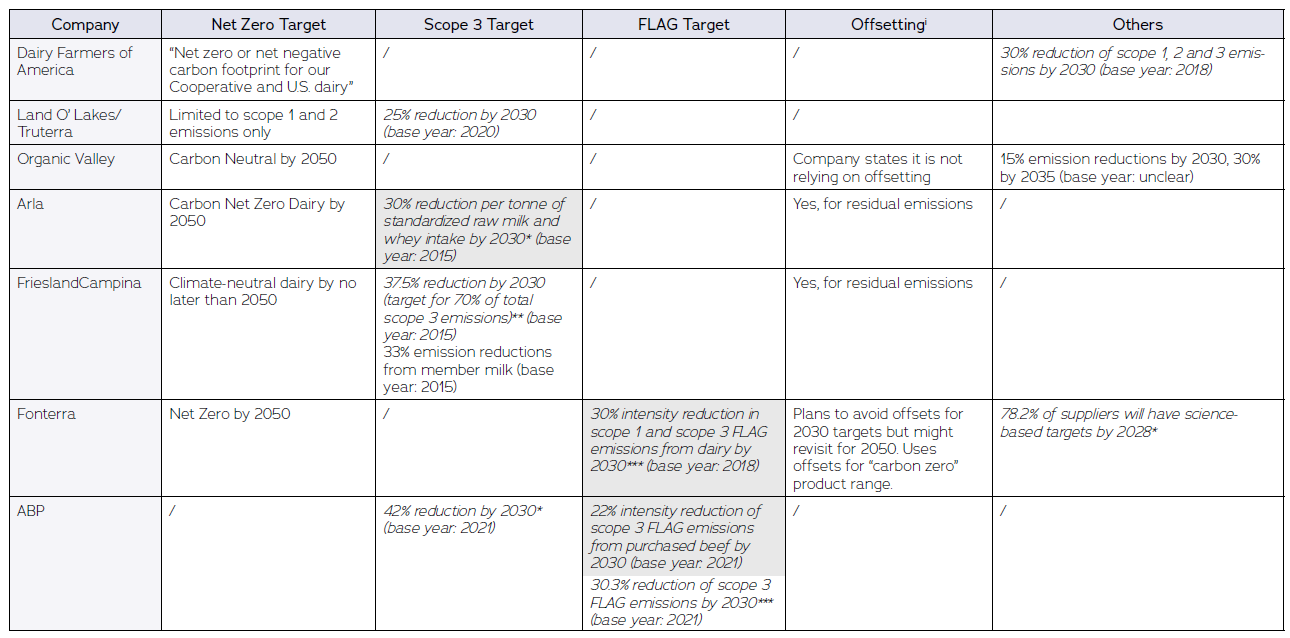

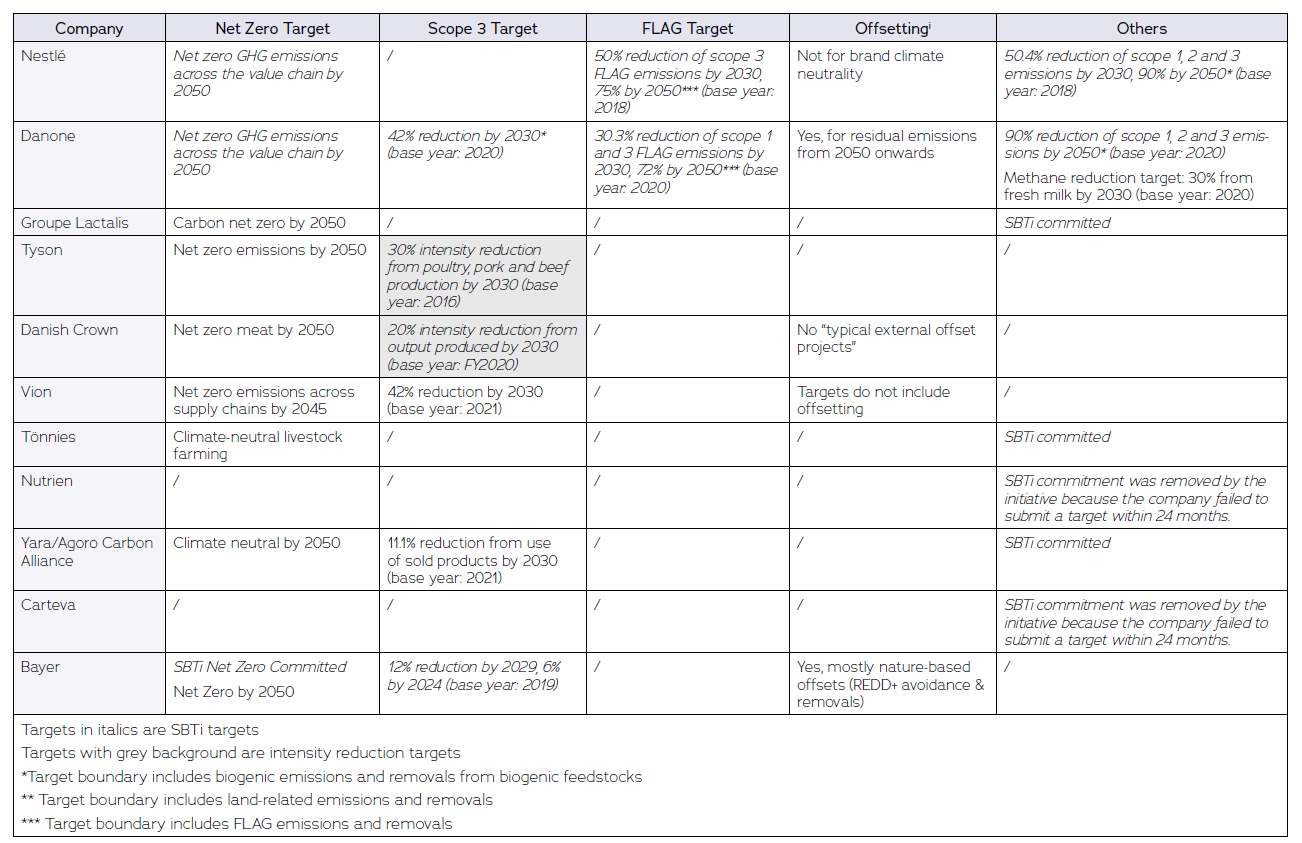

Table 2: Supply chain-related climate targets of the analyzed companies.

i. "Offsetting" column based on public statements made by the companies. However, as the discussion in section 5.1 highlights, several other activities a company pursues are hardly distinguishable from traditional offsets. Lack of concrete public statements of the companies is indicated with “/”.

Note: Scope 3 emissions are the company’s indirect emissions stemming from its supply chain. FLAG emissions are emissions to forestry, land and agriculture.

See Annex for Table references.

5.2 Tinkering around the edges or transformational change?

A transformation of our food and agriculture sector is necessary to create a food system that operates within planetary boundaries and that can sustainably feed future populations. Envisioning what that transition and possible pathways would look like has only recently begun.[85][86]

It will require creating new possibilities for existing and new farmers to earn a livelihood, which achieve the transition away from industrial animal farming, significant reductions in fertilizers and other inputs in a move towards more circularity on farm, and the restoring peatlands and other ecosystems. Moreover, restoring the health of continuously degrading soils and grasslands must be pursued to ensure the resilience of the bases of food production. Improving the health of soil and pastureland has the useful byproduct of also increasing the amount of carbon stored in those agricultural ecosystems.

Improvements in animal health, modifications to animal feed or alternative approaches to manage animal manure can also reduce emissions. These technical alterations may contribute to cutting a limited number of GHG emissions in the near-term. However, adopting some of these measures at scale risk reinforcing the existing industrial farming model rather than transitioning away from it. These technologies alone are insufficient to achieve the necessary emissions cuts from the livestock sector.[87][88][89]

In assessing the transformative nature of these measures, it is important not to adopt carbon tunnel vision. To address the multiple challenges facing the agri-food sector — including the biodiversity, soil health and water crises — holistic solutions are needed that go beyond simply cutting emissions. Here again, technological fixes may ignore the broader impacts on ecosystems, such as water contamination through concentrated animal waste, or the negative side effects of these measures, including on animal welfare.[90]

The transition will require a significant re-orientation of business plans for the major agri-food corporations, beyond actions at farm-level. It will be necessary to move beyond a growth-based model to one that focuses on generating added value with fewer animals. This may include shifting to higher value meat and dairy products or diversifying product portfolios to include more plant-based offering.

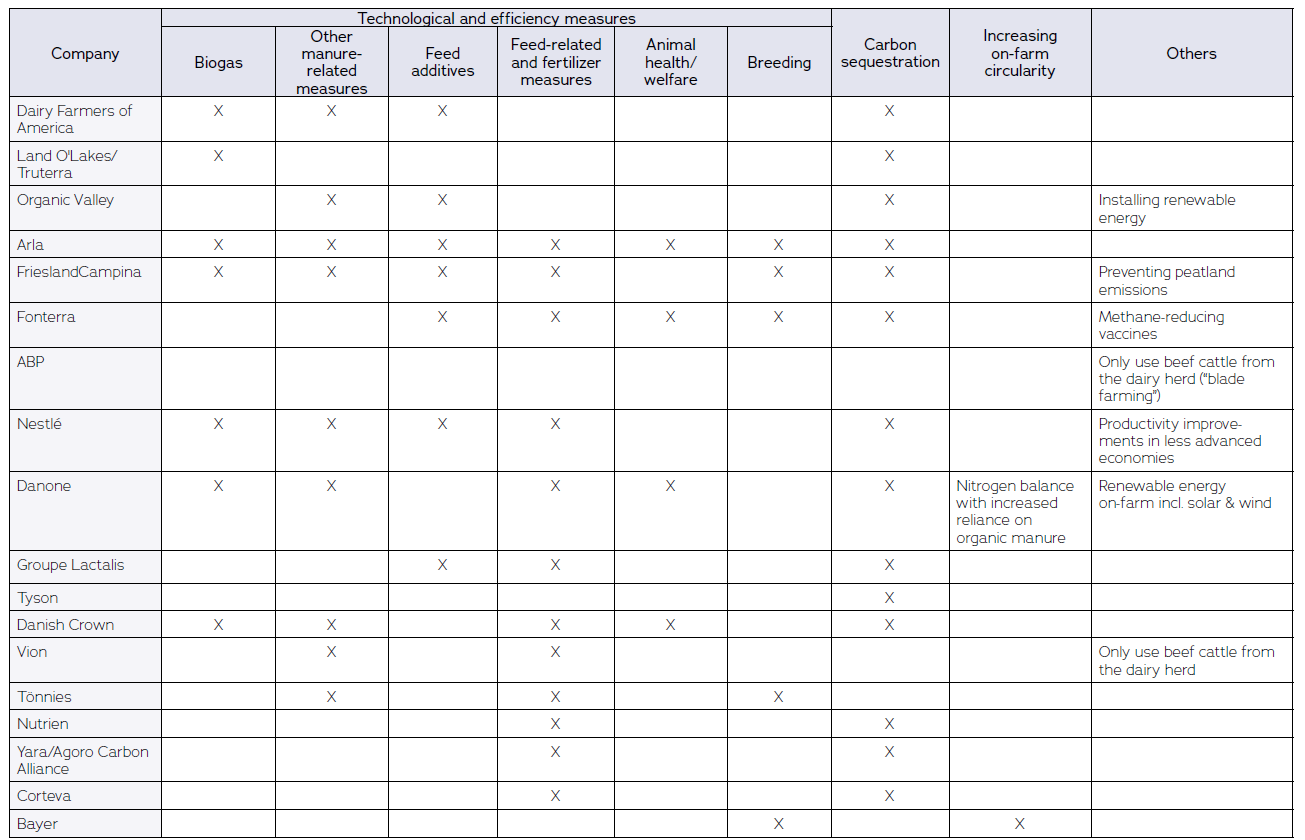

The activities agribusinesses are choosing to support at a farm-level are an important first indicator of the scale of commitment to climate action and whether they have started this transition planning.

No evidence of moving beyond the status quo

The food and livestock companies surveyed rely on techno-fixes to support their GHG emission reduction efforts (Table 3). Two of the most popular approaches are manure gasification for biogas production and feed additives designed to reduce methane emissions from cattle digestion. Both support the existing industrial farming model without challenging its core issues.

- Biogas is produced through anaerobic digestion of animal manure or other organic materials, such as energy crops and food waste. Once captured, the gas can be burned on the farm for heating purposes or to generate electricity. Biogas does not have the same level of methane purity as its fossil gas counterpart; however, it is possible to remove those impurities to the point that it can server as an alternative to fossil gas. This upgraded form is called biomethane. The solids and liquids that remain after the digestion process (referred to as digestate) are often repurposed as fertilizers.

Producing biogas or upgrading it to biomethane requires not only building the necessary infrastructure, but also a steady supply of animal manure. This dependence on manure as a feedstock incentivizes the maintenance or expansion of high-density livestock production, as this is often the most economical. The International Energy Agency has noted that biogas operations require economies of scale, meaning a small herd — like the EU’s average herd size of 50 dairy cows — is not enough to sustain such a setup economically. [91] There is evidence of these incentives are playing out in practice. Assessments in the U.S. show that on farms with biogas digesters, herd sizes grew more than on other farms in the state.[92] For example, in Wisconsin, U.S., herd sizes grew by close to 60% on average after the installation of biogas digesters.[93]

The genuine climate benefits of biogas and biomethane usage are also questionable. Research has found that current leaks of methane and nitrous oxide emissions during biogas production, upgrading and the storage of digestate can cancel out any of its climate benefits.[94] Moreover, the way its GHG emission reduction potential is calculated creates the impression that it can achieve a much larger impact than if one took a systems approach. Biogas is often presented as a way to address GHG emissions from livestock ”waste,” as such its emissions potential is calculated by comparing the GHG emissions avoided from capturing and burning the gas, compared to what would be released to the atmosphere had the manure been left to decompose. If it is instead considered as a byproduct of livestock production, then GHG emissions from land-use changes related to feed crop cultivation ought to be included in the assessments. [95] The GHG emissions benefits of biogas are dwarfed by those needed to raise the livestock in the first place.

- Feed additives are among the more recent developments in the sector, aiming to suppress the methane production in (mostly) cow’s rumen. They range from adding red seaweed or certain oil blends to feed to modify the rumen microbiome, to more advanced products, like the substances the feed additive Bovaer contains to block enzymes involved in producing methane in the animal’s rumen.

To date, studies have shown mixed results for their emission reduction potential, especially over the long term.[96] One big challenge is that these additives must be administered frequently because they break down quickly, making their use more feasible in controlled feedlot environments than in pasture-based systems.[97] Analysis suggests that while these additives can help reduce GHG emissions in high-intensity settings, a systemic shift away from intensive farming would yield in many cases greater benefits than implementing short-term mitigation techniques.[98]

Beyond these two, the scope of GHG emission reduction measures vary by company (Table 3). Companies such as Fonterra, Arla, Nestlé and Danone have introduced detailed climate strategies, listing practices like enhancing animal health, lowering protein content in feed, using deforestation-free feed and improving pasture biodiversity. While some of these measures may reduce GHG emissions partially or improve certain aspects of sustainability, they lack the transformative impact necessary to align with regional and global climate goals.

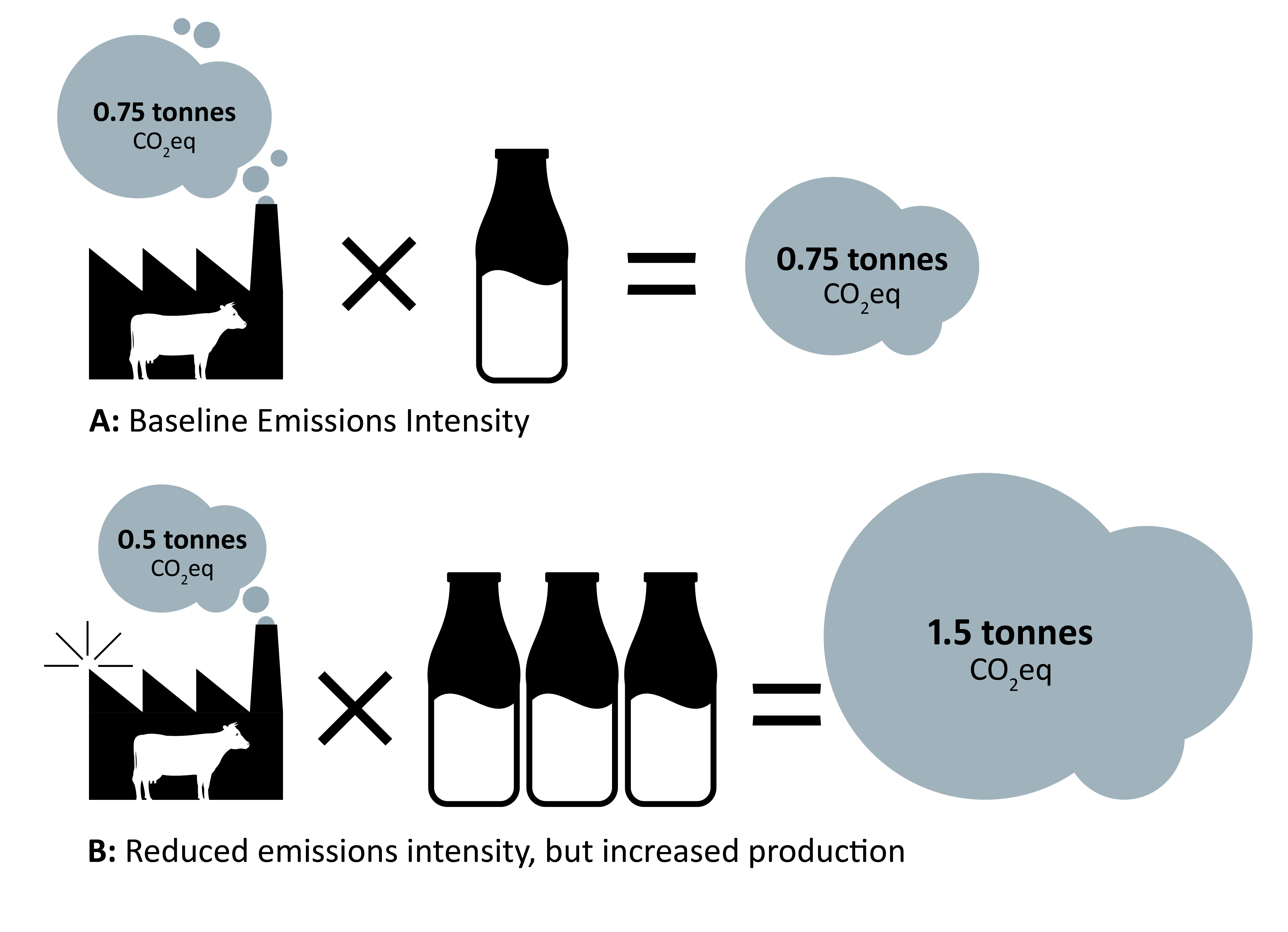

This is in line with the observation that some food and livestock companies only have targets to improve GHG emissions intensity of the meat and dairy they sell. The dairy companies Fonterra and Arla, as well as the meat processors Tyson and Danish Crown set targets to reduce GHG emissions intensity of their dairy, not absolute reductions of their emissions (Table 2). However, to address the climate crisis, absolute emission reductions are needed — efficiency alone will cannot guarantee absolute reductions. Increasing production could offset any gains in emissions intensity reduction (Figure 5).

Fonterra, the largest global dairy exporter based in New Zealand, acknowledges that for the last 15 years, its dairy GHG emissions intensity has barely changed. In fact, any efficiency gains have been “offset by higher emissions associated with the production of imported supplementary feed and fertiliser.”[99] The company also recognizes the conflict between its supply chain GHG emission reduction target — based on GHG emissions intensity — and the need to reduce absolute GHG emissions. The company states that meeting absolute regulatory targets requires reducing livestock numbers. However, cutting herd sizes could impact Fonterra’s GHG emissions intensity goal if milk productivity drops.[100] Fonterra argues that customers primarily care about GHG emissions intensity per product unit,[101] and even though that might be debatable, from a climate perspective, absolute GHG emission reductions are non-negotiable.

It can be concluded that the analyzed food and livestock companies are still largely avoiding a fundamental shift toward sustainable business models that would involve generating added value with fewer animals.

Although some companies, such as Nestlé or German meat processor Tönnies, are expanding their portfolios to include plant-based products, neither have committed to reducing the number of animals in their supply chains. This reluctance to change is evident in their continued reliance on practices that prop up high-intensity production models, often using technological add-ons rather than addressing the broader impacts of industrial livestock production on the environment.

In fact, some approaches work in the opposition direction. Take for example Nestlé’s Net Zero Roadmap: The company states it will reduce the emissions intensity of its fresh milk mainly through “improvements in productivity in less advanced economies,”[102] typically leading to further intensification rather than moving away from the polluting factory farm model. Without a move toward more agroecological systems, prioritizing selling fewer but more sustainably produced dairy and meat products, the climate strategies of these companies are unlikely to live up to their promises.

Figure 5: The Emissions Intensity Trap: Reduced emissions intensity and increased production, but higher absolute emissions

An emphasis on carbon farming avoids the real issue

Most companies analyzed in this report rely to some extent on carbon sequestration (Table 3). This approach involves storing carbon in soils — often referred to as “carbon farming” — or planting trees in pastures, a practice referred to as silvopasture. While both practices are important for their climate and biodiversity benefits, they need to be pursued for their own sake and not as a replacement for action not taken elsewhere or as a diversionary tactic.

Producing food within planetary boundaries requires reducing the GHG emissions associated with that production. While carbon sequestration in grasslands and croplands would be important even in the absence of the climate crisis to ensure healthy and resilient ecosystems, it cannot replace these needed GHG emission reductions. By taking credit for carbon stored in soils, companies can hide their lack of action to reduce their actual GHG emissions, as, on a net basis (GHG emissions minus the carbon stored in soils), it appear that they are improving.

Carbon sequestration can also serve as a diversionary tactic to draw attention away from industrial livestock production. Carbon sequestration in livestock farms may be promoted through pasture-based grazing, adding trees on pastures on marginals lands, or planting hedges around fields.

Yet, there are two elements to be mindful of here. The first is the carrying capacity of the land. Simply putting cows out to pasture is not a straightforward solution, since overgrazing can occur. Having too many animals in one location without recovery time for the grasslands causes harm to water and biodiversity.[103] In addition, research has shown that for carbon sequestration to counterbalance livestock emissions on paper, soil carbon stocks would need to increase drastically, to levels that are simply not feasible at current levels of livestock production.[104]

The second issue is transparency around the number of animals raised in such conditions. Some companies like Tyson and Nestlé claim to support silvopasture or grazing, but do not provide information on the extent of those activities, specifically on how many of their animals are actually raised in these conditions, making it difficult to evaluate the level of their commitment to the transition.

Beyond livestock rearing conditions themselves, carbon farming practices are also promoted by food and livestock companies for feed production. These practices include low or no-till agriculture and cover cropping. However, tracking where feed originates from remains challenging due to limited transparency across supply chains. To address this gap, livestock companies increasingly turn to feed and fertilizer suppliers who can provide carbon credits linked to crop production that might include feed (Section 5.1).

The reasons to pursue enhancing carbon sequestration as a separate and distinct mitigation strategy are due to the peculiarities of the process itself, which is fundamentally different to emissions released into the atmosphere. Carbon stored in soil and trees is not permanent but can be re-emitted to the atmosphere if farming practices that promote storage are discontinued or changed, or as the result of an extreme weather like forest fires or flooding. Within agriculture, there is also a temporal mismatch between emissions from livestock and crop production, whose adverse impact on the climate is immediate and strongest in the near-term, and the ability of soils and grasslands to store carbon, which occurs on a much slower timeline (Box 1).[105]

Table 3: Activities supported by companies as measures to reduce their supply chain emissions

See Annex for Table references.

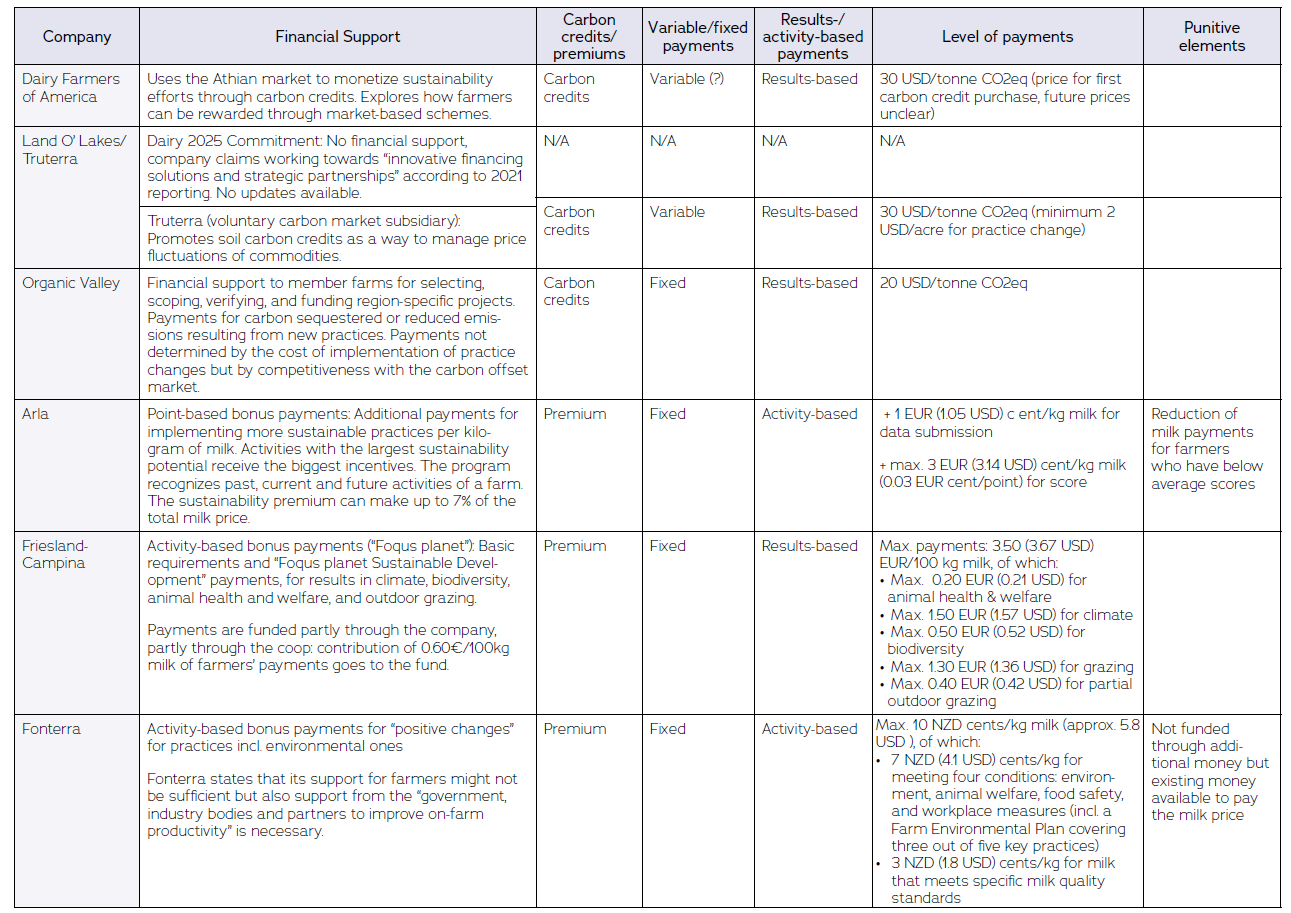

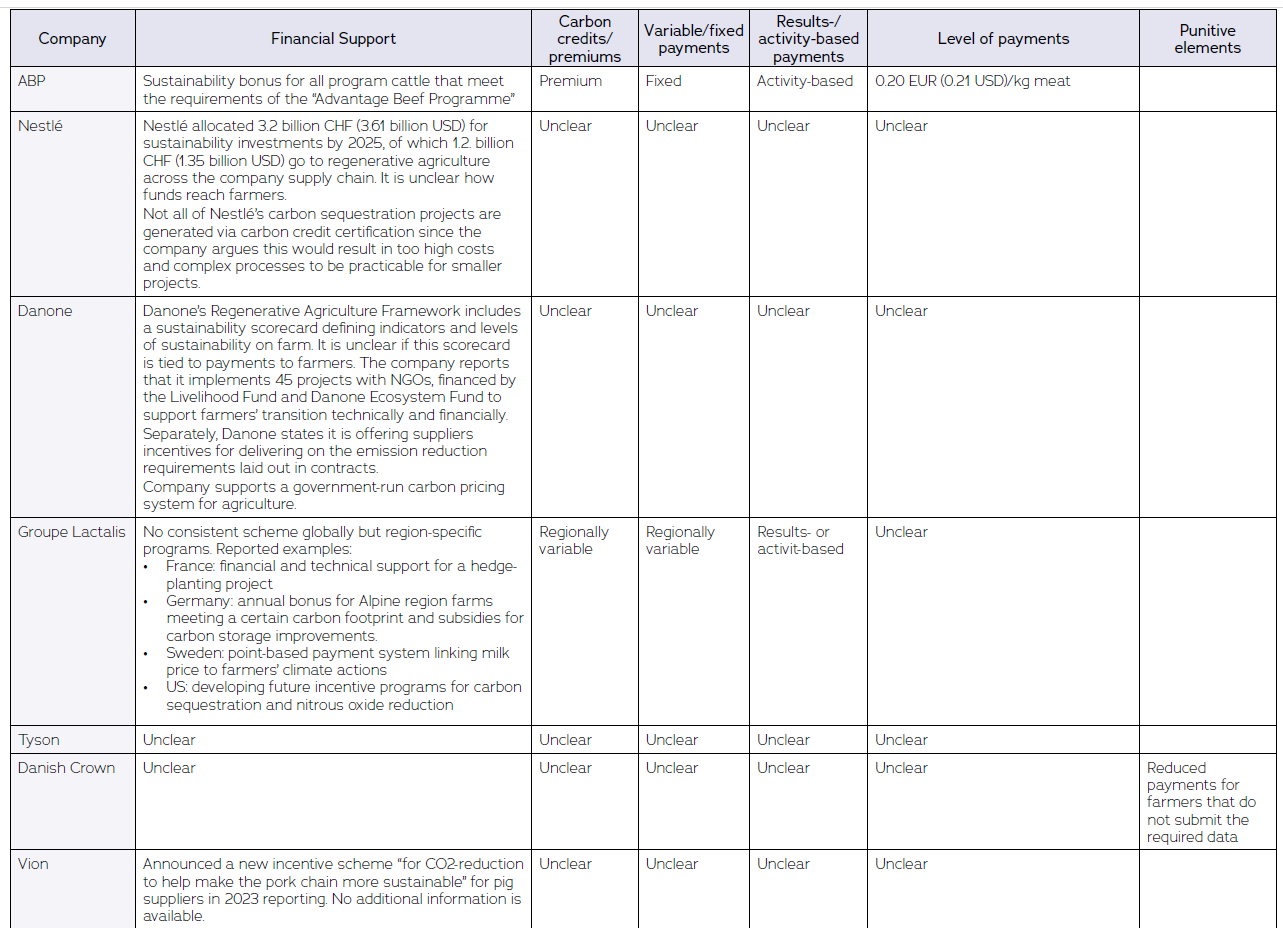

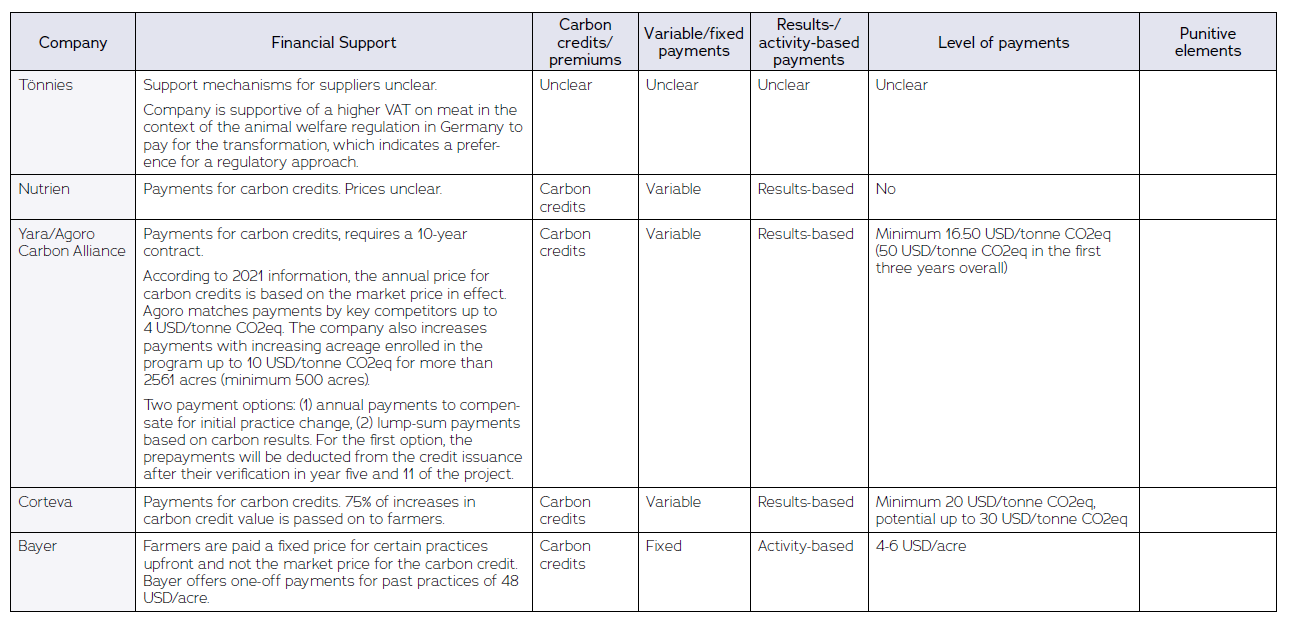

5.3 Limited financial support for farmers unlikely to spur a just transition

The push to produce cheap meat and dairy has fueled industrial farming, making it difficult to shift toward sustainable practices. A major challenge across sectors is deciding who should bear the costs of the transition. Although evidence shows that sustainable farming can be profitable, financial support is essential to help cover the initial transition[106] and production costs. A recent industry report suggests that downstream agribusiness would be capable of shouldering more of the cost and risk of this transition. It estimates that costs could be as small as 3% of the revenues of a typical meat trader and less than 1% for a multinational food company.[107]

Understanding the types of payment schemes already being used is key to identifying which ones best support farmers, benefit the climate and can provide insight for regulators. Our assessment focused on the types of schemes being developed and their ability to provide sufficient and predictable support for farmers.

Market-oriented or premium based schemes are more common, though transparency is lacking

Agribusiness approaches to incentivize farmers vary significantly, with different levels of support and engagement (Table 4). Several companies did not disclose much detail about their programs, limiting the extent of the analysis. From the companies surveyed, two main approaches to provide incentives for farmers were identified:

1. Results-based payments for carbon outcomes

Under this market-oriented approach, farmers generate carbon credits when reducing GHG emissions or sequestering carbon through various farm practices. These can then be sold to agribusinesses as an additional source of revenue. These credits are often validated by entities independent of the agribusiness. However, agricultural input companies may also take on this role, certifying the carbon credits of farmers in their supply chains. This model usually only rewards new actions and does generally not provide payments for ongoing practices that already meet sustainable standards.

The U.S. dairy companies Dairy Farmers of America and Organic Valley have adopted this model. They partner with third-party certifiers — Athian and SustainCERT respectively — to calculate and verify emission reductions or carbon sequestration on farms. Agricultural input companies, like Corteva, Yara and Nutrien have also adopted this approach.

2. Activity-based premium payments for sustainability standards

Activity-based payment schemes use point-based frameworks or ranking systems where farmers receive bonuses based on the number or quality of practices implemented. Generally, farmers may receive support for existing sustainable practices and not just for the uptake of new measures.

Activity-based payments are popular among dairy companies like Arla, FrieslandCampina, Fonterra and meat processor ABP. For instance, Arla’s scheme awards the highest incentives to practices with the most significant “sustainability potential.” Fonterra pays bonuses for meeting certain environmental and milk quality standards.

Some companies appear to focus on smaller scale project-based financing rather than a scheme applicable to all their suppliers. Companies like Danone use detailed scorecards to lay out their vision for agriculture. However, there seems to be no comprehensive payment scheme tied to reaching a certain level on the scorecards. Instead, Danone runs different projects that claim to offer financial and technical support. Lactalis, the world’s largest dairy company, provides region-specific incentives, such as point-based systems in Sweden or bonuses for carbon footprint reductions in Alpine regions. These incentives do not seem to extend across its entire supply base. This selective approach limits the reach and consistency of financial support available to farmers, hindering widespread adoption of more sustainable practices.

The global food company Nestlé relies on two different supply streams of dairy: directly from farmers that is processed in Nestlé’s own plants and through other dairy companies. While Nestlé does not seem to have an incentive scheme for all of it suppliers, it does collaborate with the New Zealand dairy company Fonterra where Nestlé funds sustainability payments for Fonterra farmers.

It was not possible to find information about the financial incentives provided by several of the agribusinesses reviewed as part of this analysis. Tyson, Danish Crown and Tönnies do not provide any information about their financial support for farmers. Details are sparse for others. Dutch pork processor Vion announced an emission reduction incentive scheme for 2023, though details about the scheme have not yet been released.

Premium models provide more stable support to farmers but questions about sufficiency remain

Between the two most common schemes, the premium model provides more stable financial support to farmers, though it is questionable if they will provide the level needed to support the transition.

Carbon credits prices have been well below the level needed to spur a substantial change in farm practices.[108] Dairy Farmers of America purchased for their first credits through the certifier Athian in January 2024, the farmer receiving reportedly at least 30 USD per tonne of CO2eq.[109] What price per tonne is needed to foster changes in farm practices will vary by region and the practices considered, however a carbon credit trader estimate suggests that the price would need to be at least 2.5 times higher to bring about meaningful change.[110] However, payments tied to carbon credits sold on the voluntary carbon market have been low, yielding only 15-20 USD per ton of CO₂eq for farmers.[111]

The example of Organic Valley illustrates that limited financial incentives are not driving change. Organic Valley pays farmers 20 USD per tonne for certified carbon sequestration or emissions reductions according to 2023 reporting. The company recognizes that its payments, based on a rate deemed competitive with the voluntary carbon market rather than covering the actual implementation costs, have limited influence on driving change. However, it states that the technical support provided by these programs can be of greater assistance to farmers than the financial incentives.[112]

Agricultural input companies mostly pay farmers market prices for carbon results that are sold in the form of carbon credits. These payments are equally insufficient, with minimum prices of 16.50 USD to 20 USD per ton of CO₂eq, and up to potential payments of 30 USD (Table 5). In some cases, the structure of these schemes favors larger farms. For example, according to 2021 reporting, Yara International’s Agoro Carbon Alliance’s operations in the U.S. pay up to an additional 10 USD per acre if a farmer enrolls more than 2,500 acres (approx. 1,000 hectares) and requires a minimum of 500 acres (approx. 200 hectares) to qualify for the program.[113] Bayer’s U.S. carbon program applies a different strategy, paying a fixed price per acre on which farmers implement eligible practices instead of per tonne of carbon sequestered, ranging from 4 USD to 6 USD per acre. Bayer also offers payments of 48 USD per acre for practices that have been applied in the past[114] — past performance improvements usually cannot be sold as carbon credits on the voluntary carbon market.

Beyond price itself, another problem of market-based payments is the lack of predictability of payments. While there might be guaranteed minimum prices, they can fluctuate significantly. In addition, the results of farm practices to cut emissions or store carbon might not turn out as expected. Depending on company policies, farmers then receive less money than they anticipated for the activities they have already carried out.

Companies that provide more predictable incentives, like Arla, FrieslandCampina and Fonterra, offer fixed sustainability premiums that do not fluctuate with market prices. To receive these additional payments, farmers either collect a certain number of points by implementing measures on farms, or they comply with minimum conditions outlined by the companies. Payments are issued on top of prices per kilogram of meat or liter of milk. Given this difference in payments, a direct comparison of farmer payments with market-based rewards is challenging. Arla, FrieslandCampina and Fonterra pay similar levels of premiums, ranging from three to five Euros per 100kg of milk.

While these schemes may provide more stable sources of financial support, they are not without their own drawbacks. Their ability to support the transition is questionable due to how the schemes are designed. A point-based system may incentivize action on the low-hanging fruit, which, though they pay less, may be easier to achieve, rather than undertake more fundamental changes.

Moreover, the effectiveness of these payments will not only depend on the level of incentives but on the question if they represent additional payments. Fonterra, for example, was criticized in the past for linking a share of its milk price payout to sustainability targets since the funding would come from the existing money available to pay farmers rather than from additional funds.[115] FrieslandCampina’s sustainability scheme is partly paid for by the company and the customers buying the dairy products, partly by the cooperative through farmers’ contributions.[116] Researchers from Wageningen University found that premium payments are not always perceived positively, but as “a redistribution of profits or a penalty.”[117]

In fact, some companies incorporate penalties within their sustainability programs. Arla, for instance, reduces milk payments for farmers who score below average on sustainability metrics within its point-based system.[118] Danish Crown requires its supplying pig farmers to submit specific sustainability data as part of their standard reporting; if they fail to comply, their payment is reduced.[119] Such penalty policies are problematic, especially if the incentives offered by the companies do not cover the cost of implementing changes. They force farmers to foot the bill for the transformation.

Public funds used to support corporate initiatives

Companies in the U.S. like Dairy Farmers of America, Organic Valley, Lactalis’s U.S. operation Stonyfield, Land O’Lakes’ carbon market branch Truterra, and Tyson benefit from federal support through the USDA’s Climate Smart Commodity Program, which funds their sustainability programs.[120] Dairy Farmers of America states that the goal is to “create a self-sustaining cycle where DFA’s farmer-owners are incentivized to continue to reduce on-farm GHG emissions” and that 90% of the public funds received goes to their member farmers.[121] However, this USDA program is a short-term public program that will only deliver temporary finance. The reliance of companies on public funds to pay for their sustainability schemes draws into question if they have fully internalized the costs of sustainable transitions within their own supply chains. Given the limitations of the premium and market models, public money may be better used by reforming core agricultural support programs like the U.S. Farm Bill or EU Common Agricultural Policy to provide support for environmental services, with separate measures to ensure agribusiness are contributing their fair share to supporting the transition.

Table 4: Company schemes to financially reward farmers’ sustainability efforts, including climate measures

See Annex for Table references.

5.4 Risks of aggravating power imbalances in agri-food supply chains

Governments around the world are developing legislation to hold corporations accountable for their greenhouse gas emissions, not only in their own facilities, but also increasingly throughout their supply chains.[122] The European Union’s Corporate Sustainability Reporting Directive, for example, requires more detailed, comparable and transparent reporting on emissions, including their supply chain emissions, carbon removals and carbon credits. As a result of this trend, companies are looking to strengthen their ties with their supplier networks, not only to collect the data deemed necessary for reporting purposes, but also to achieve emission reductions within their supply chains. The EU’s reporting regulation allows the use of regional default values, but these values are not sensitive to individual on-farm changes in the company supply chain. Consequently, to show that their emissions are lower than estimated default values, companies need to collect on-farm data.[123]

As the demand for data grows, so too do the concerns over whether it is appropriate for companies to own such detailed and sensitive data about individual farms. The issues are not new, as there has long been concern over the role of data collection in new agriculture technologies (like the data collected by farm machinery),[124] but the reporting systems add another layer to this issue.

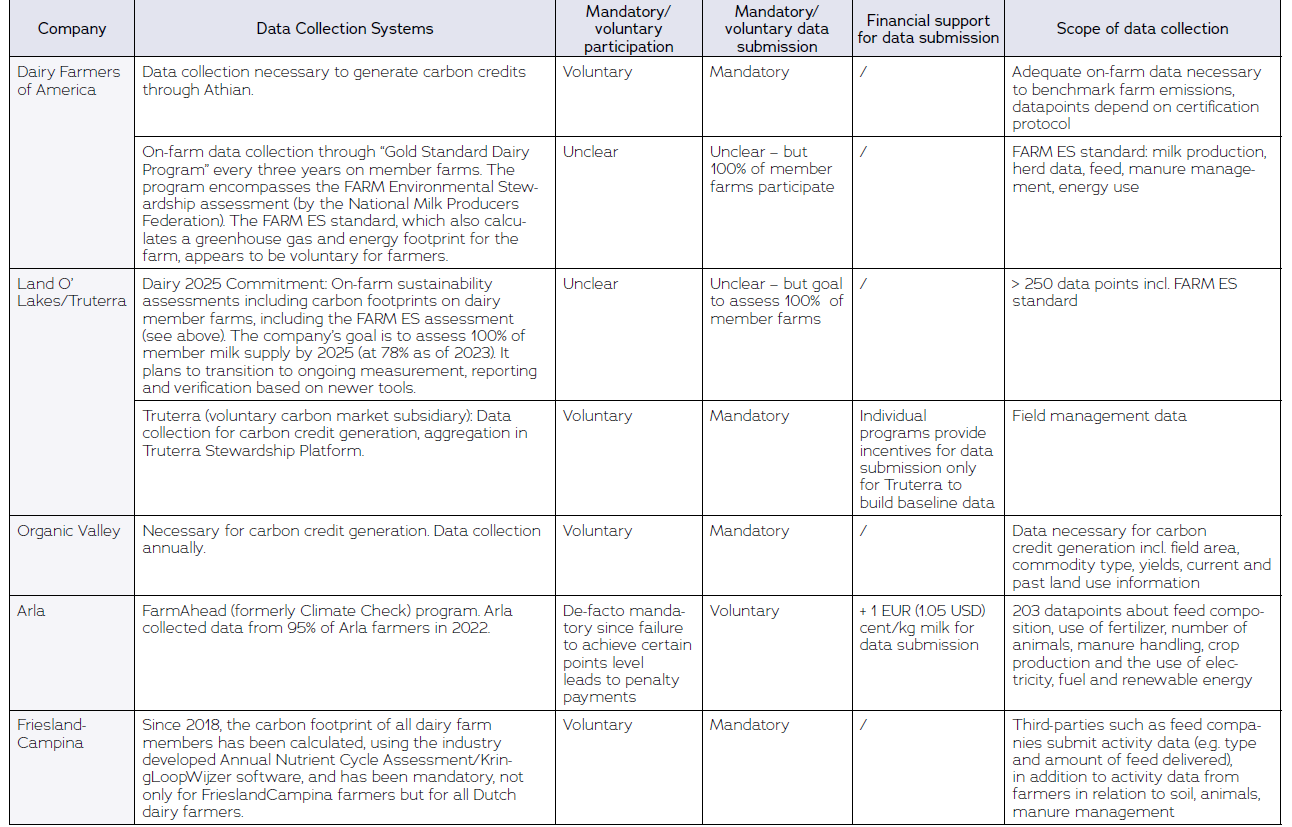

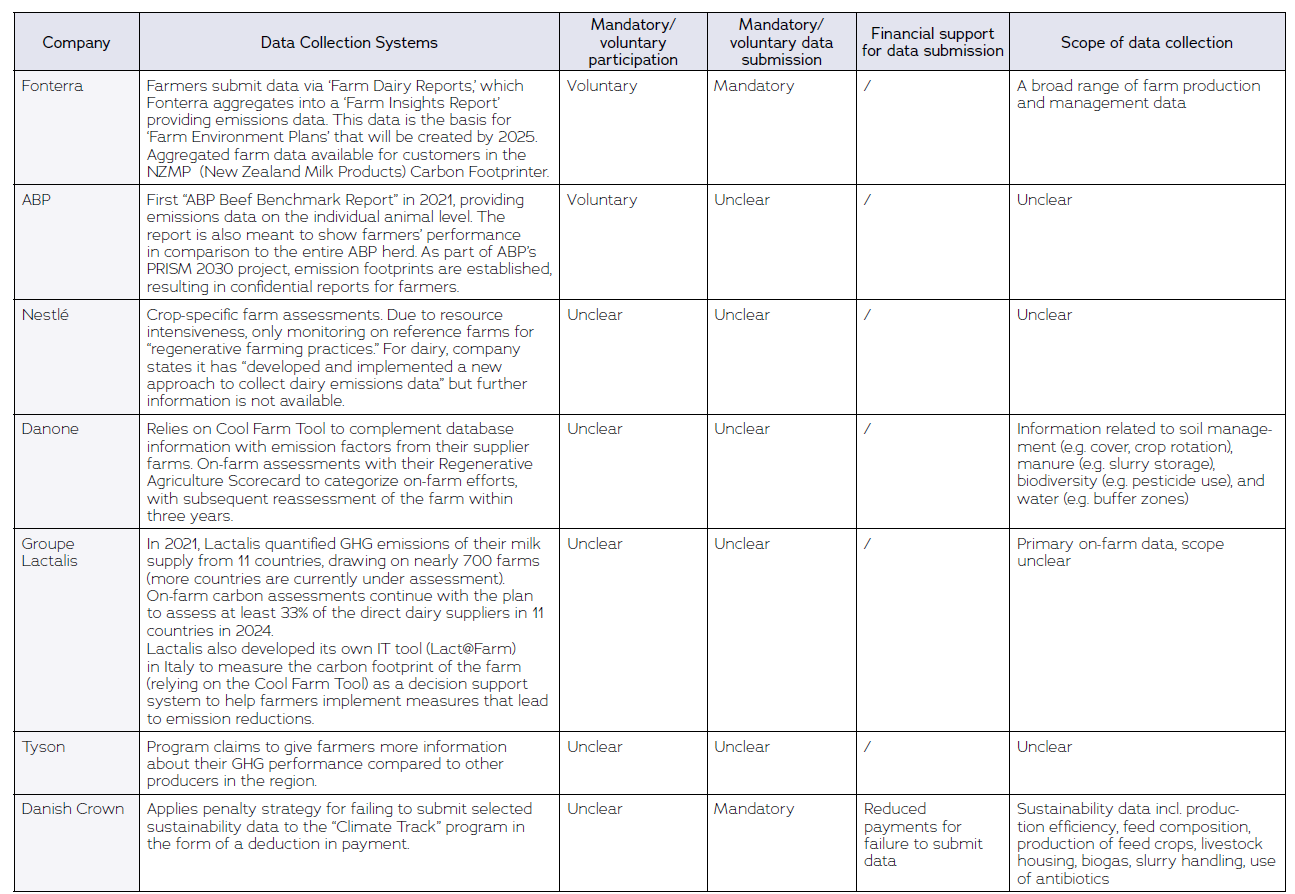

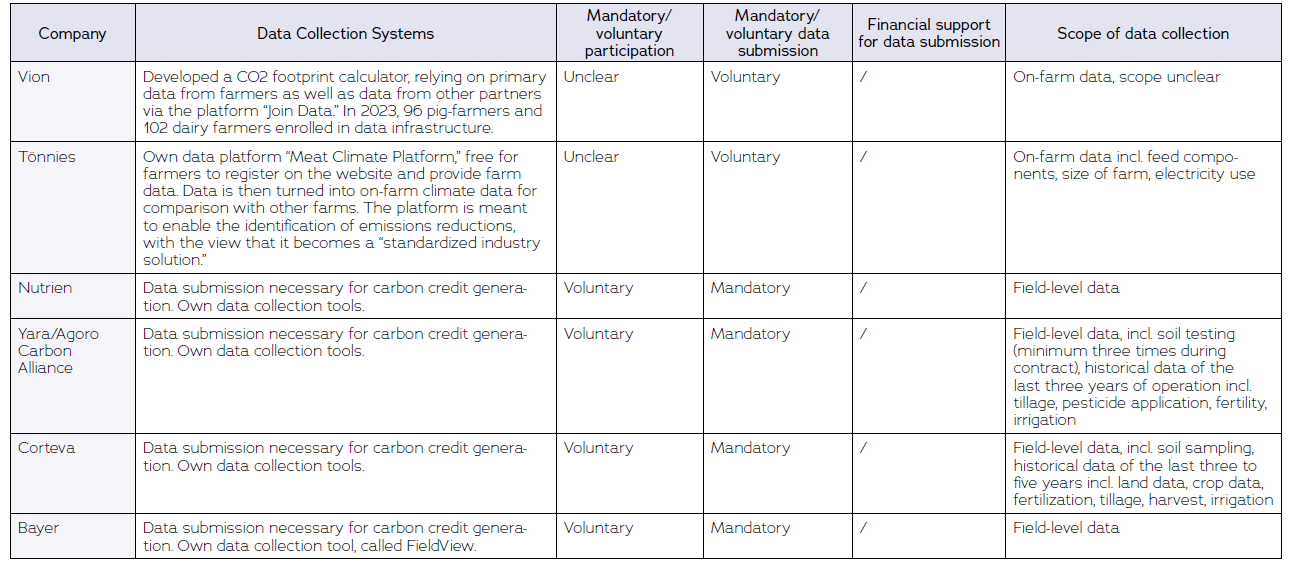

All the companies analyzed collected data from farmers, with several requiring mandatory data submission (Table 6). The data collection can be extensive. It ranges from the numbers of animals and feed characteristics to farming practices and energy use. For example, Arla collects over 200 datapoints under its scheme.

Our research methods, which focused on analyzing corporate reporting, do not lend themselves to evaluating the effect these programs are having on farmers. However, statements made by companies do give an indication of two related areas worthy of attention as these schemes develop: the growing dependency of farmers on these corporate initiatives and potential conflicts of interest.

As a result of companies imposing sustainability criteria and requiring data submissions in their supplier contracts, companies gain more control and insights into farmers' operations. Truterra, for example, promises the companies that it sells carbon credits to a more tight-knit vertical relationship and deeper insight into farmers’ operations.[125] This raises a key issue for consideration in policy debates: While corporate accountability is important, increasing regulation could lead to more power concentrated in the hands of a few companies dictating on-farm practices. Farmers may also become less flexible in choosing suppliers if they have already invested in meeting one company’s rules through supplier contracts and sustainability schemes.[c]

Farmers’ increased dependencies are not only a concern with respect to meat and dairy companies but also in relation to input companies. Agricultural input companies facilitate the generation of carbon credits for a small set of practices (Section 5.2), which may encourage the use of their products, such as the reliance on pesticides in no-till agriculture. Critics argue that even if farmers are not directly obligated to buy a specific company’s products, carbon credit contracts and close contact might serve as a tool to bind farmers to the company and its products since carbon credit programs come with agronomic advice on how to achieve the best outcomes.[126] For example, Corteva views its carbon program as a means to deepen its connection with farmers, while Nutrien uses it to sell high-margin products like crop treatments and fertilizers.[127]

Beyond increasing dependencies, there is also an inherent conflict of interest if manufacturers of agricultural input products make agronomic recommendations, as the companies are unlikely to recommend farmers to use less of their products. Some companies, like Yara, have recognized this potential conflict and separated from its carbon credit project, Agoro Carbon Alliance, to build trust with farmers. Nevertheless, Agoro remains 100% owned and backed by Yara.[128]

The digital platforms used to implement the programs might be designed to best work with a company’s other products. For instance, Bayer’s FieldView platform, when combined with its corn hybrids, creates a system that offers tailored recommendations.[129] Although Bayer claims farmers do not need to use their seeds or inputs to participate in carbon programs, experts have noted that FieldView subscriptions are bundled with seeds and pesticides for rebates, effectively tying them together.[130]

While the push by governments to hold corporations accountable for their emissions will surely continue, it is important to be mindful of how that push trickles down to the farm level and what kind of protection systems for farmers might be necessary.

Table 5: Scope and level of obligation of company systems to collect on-farm data

See Annex for Table references.

6. Conclusions

In order to achieve a transformation of the agriculture sector and our food system, all stakeholders need to contribute, especially the companies that hold significant power in shaping the agri-food system. However, this report shows that even though some frontrunner companies are implementing new strategies, they are unlikely to drive the change needed.

The company approaches do not fundamentally change the polluting industrial livestock production system but are betting on technological fixes and carbon sequestration to meet often ineffective climate targets. In some cases, new language is simply used to cover up old offsetting strategies. The fact that companies rely on both carbon sequestration within their supply chains, as well as external offsets, shows that they are not doing enough to address their actual GHG emissions.

Agriculture has long been the forgotten sector of climate policy. It is far-fetched to believe that agribusiness will voluntarily deliver the required changes at the speed or scale needed. As countries develop their next set of climate targets, specific targets should be considered for the agricultural sector with a suite of policy measures designed and implemented to ensure these are met.

While some companies have developed financial incentive models for supplier farmers, they are unlikely to be sufficient to finance a just transition. In fact, these models can result in adverse effects, increasing corporate control over farmers and reducing their flexibility in the market.

As the tables above highlight, data is lacking for several companies. The regulations of climate reporting underway in the European Union are a step into the right direction. But also, how companies are collecting farm data needs to be consistent to make it easier for farmers. Additionally, climate actions requested of farmers need to be predictable, consistent and pay enough to cover costs. The market for farmers needs to be more transparent and competitive to give farmers more options. Issues related to data access, control and the ability of farmers to share in the benefits of insights gleamed from data aggregation should be considered as policy in this area develops.

The transition to a different food and agriculture system is inevitable, but whether the transition will be just and well-managed is not. The challenge lies in creating systems that respect planetary boundaries while ensuring fair livelihoods for farmers and workers.

Download a PDF of this report.

Annex: References for data included in the report tables

Footnotes

[a] The non-profit NewClimate Institute criticizes ‘insetting’ as “an illegitimate approach that could have the potential to significantly undermine companies’ [climate] targets” because it is used to disguise offsetting practices that lack any independent verification processes. New Climate Institute, “FAQs - Corporate Climate Responsibility Monitor 2023,” February 13, 2023.

[b] Column based on public statements made by the companies. However, as the discussion in section 5.1 highlights, several other activities a company pursues are hardly distinguishable from traditional offsets. Lack of concrete public statements of the companies is indicated with “/”.

[c] It is important to highlight that in many regions, farmers do not have many choices between companies they can supply. Flexibility to choose a company to supply is already reduced due to market concentration.

Endnotes

[1] Food and Agriculture Organization of the United Nations, “Greenhouse Gas Emissions from Agri-food Systems. Global, Regional and Country Trends, 2000-2020.” (Rome, Italy, 2022), 3, https://openknowledge.fao.org/server/api/core/bitstreams/121cc613-3d0f-431c-b083-cc2031dd8826/content.

[2] Michael A. Clark et al., “Global Food System Emissions Could Preclude Achieving the 1.5° and 2°C Climate Change Targets,” Science 370, no. 6517 (June 11, 2020): 705–8, https://doi.org/DOI: 10.1126/science.aba7357.

[3] Leonardo Nascimento et al., “Twenty Years of Climate Policy: G20 Coverage and Gaps” 22, no. 2 (October 29, 2021): 158–74, https://doi.org/10.1080/14693062.2021.1993776.

[4] Lucy Craymer, “New Zealand Ends Plans to Price Agricultural Emissions,” Reuters, June 11, 2024, sec. Environment, https://www.reuters.com/business/environment/new-zealand-ends-plans-price-agricultural-emissions-2024-06-11/.

[5] WWF and Climate Focus, “Unlocking and Scaling Climate Solutions in Food Systems: An Assessment of NDCs For Food Systems Transformation,” November 2022, https://climatefocus.com/wp-content/uploads/2022/11/NDCs-for-Food-Nov2022.pdf.

[6] COP28, “COP28 UAE Declaration on Sustainable Agriculture, Resilient Food Systems, and Climate Action,” December 1, 2023, https://www.cop28.com/en/food-and-agriculture.

[7] Food and Agriculture Organization of the United Nations, “Achieving SDG 2 without Breaching the 1.5 °C Threshold: A Global Roadmap, Part 1 - How Agri-food Systems Transformation through Accelerated Climate Actions Will Help Achieving Food Security and Nutrition, Today and Tomorrow, In Brief” (Rome, Italy, 2023), https://doi.org/10.4060/cc9113en.

[8] Sophia Murphy, “Now We See It: First Thoughts on FAO’s Roadmap for Food Security within a 1.5°C Climate Ceiling,” Institute for Agriculture and Trade Policy (blog), December 22, 2023, https://www.iatp.org/now-we-see-it-fao-roadmap.

[9] Changing Markets Foundation, “The New Merchants of Doubt: The Corporate Playbook by Big Meat and Dairy to Distract, Delay, and Derail Climate Action,” July 2024, https://changingmarkets.org/wp-content/uploads/2024/07/Report-The-New-Merchants-of-Doubt_Final.pdf.

[10] GRAIN and Institute for Agriculture and Trade Policy (IATP), “Emissions Impossible: How Big Meat and Dairy Are Heating up the Planet,” 2018, https://www.iatp.org/sites/default/files/2018-08/Emissions%20impossible%20EN%2012.pdf.

[11] Institute for Agriculture and Trade Policy (IATP) and Changing Markets Foundation, “Emissions Impossible: How Emissions from Big Meat and Dairy Are Heating up the Planet,” November 2022, https://www.iatp.org/emissions-impossible-methane-edition.

[12] Sherry Madera et al., “Scope 3 Upstream: Big Challenges, Multiple Remedies” (CDP, Boston Consulting Group, June 2024), 8, https://cdn.cdp.net/cdp-production/cms/reports/documents/000/007/834/original/Scope-3-Upstream-Report.pdf?1721043058.

[13] Leila Yow, “Corporate Climate Disclosure Rules: A Global Overview,” Institute for Agriculture and Trade Policy, November 18, 2024, https://www.iatp.org/corporate-climate-disclosure-rules-global-overview.

[14] Thomas Day et al., “Corporate Climate Responsibility Monitor 2022: Assessing the Transparency and Integrity of Companies’ Emission Reduction and Net-Zero Targets” (NewClimate Institute, Carbon Market Watch, February 2022), https://newclimate.org/sites/default/files/2022-06/CorporateClimateResponsibilityMonitor2022.pdf.

[15] Thomas Day et al., “Corporate Climate Responsibility Monitor 2024: Assessing the Transparency and Integrity of Companies’ Emission Reduction and Net-Zero Targets” (NewClimate Institute, Carbon Market Watch, April 2024), https://newclimate.org/sites/default/files/2024-08/NewClimate_CCRM2024.pdf#CMW_CCRM2024_v05_PressVersion_Final.indd%3A.78226%3A2896.

[16] Amir Sokolowski et al., “The State of Play: 2023 Climate Transition Plan Disclosure” (London, UK: CDP, June 2024), https://cdn.cdp.net/cdp-production/cms/reports/documents/000/007/783/original/CDP_Climate_Transition_Plans_2024.pdf.

[17] Day et al., “Corporate Climate Responsibility Monitor 2024: Assessing the Transparency and Integrity of Companies’ Emission Reduction and Net-Zero Targets.”

[18] Eve Fraser, Sybrig Smit, and Takeshi Kuramochi, “Navigating Regenerative Agriculture in Corporate Climate Strategies: From Key Emission Reduction Measure to Greenwashing Strategy” (Cologne, Berlin: NewClimate Institute, September 2024), https://newclimate.org/sites/default/files/2024-09/Navigating%20regenerative%20agriculture%20in%20corporate%20climate%20strategies_sep2024.pdf.

[19] Feedback et al., “Big Livestock’s Greenwash,” November 30, 2022, https://biglivestockgreenwash.com/, https://biglivestockgreenwash.com/.

[20] Jonathan Foley, “Greenwashing and Denial Won’t Solve Beef’s Enormous Climate Problems,” Project Drawdown, October 30, 2024, https://drawdown.org/insights/greenwashing-and-denial-wont-solve-beefs-enormous-climate-problems.

[21] Irina Gerry, “Paint It Green: Meat & Dairy’s Top Greenwashing Tactics, Exposed,” Green Queen (blog), January 29, 2023, https://www.greenqueen.com.hk/meat-dairy-greenwashing-tactics/.

[22] Caroline Christen, “Investigation: How the Meat Industry Is Climate-Washing Its Polluting Business Model,” DeSmog (blog), July 18, 2021, https://www.desmog.com/2021/07/18/investigation-meat-industry-greenwash-climatewash/.

[23] Changing Markets Foundation, “The New Merchants of Doubt: The Corporate Playbook by Big Meat and Dairy to Distract, Delay, and Derail Climate Action.”

[24] Feedback et al., “Big Livestock’s Greenwash.”

[25] Foley, “Greenwashing and Denial Won’t Solve Beef’s Enormous Climate Problems.”

[26] Gerry, “Paint It Green.”

[27] Christen, “Investigation.”